Inditex

Introduction

Now it’s Inditex’s turn. We will answer the following key questions:

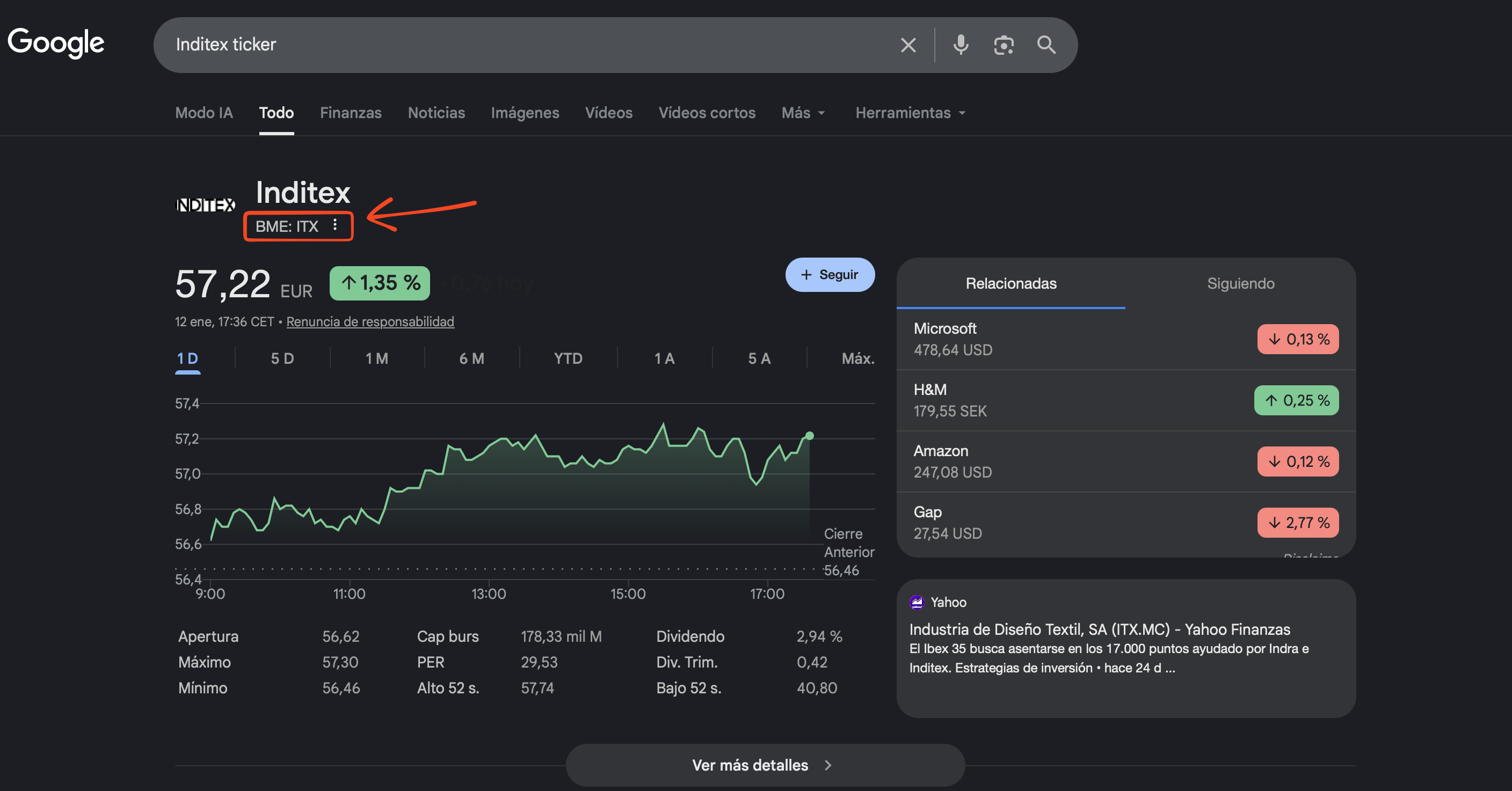

- What market does it trade on?

- Is there any known fraud case in which the management team is involved?

- Is the company part of my circle of competence?

- Quick accounting valuation

1. What market does it trade on?

The procedure is similar to that followed with Alphabet.

Method 1: Using Notebook LM

NotebookLM folder link:

We can use the quick route, asking Notebook LM:

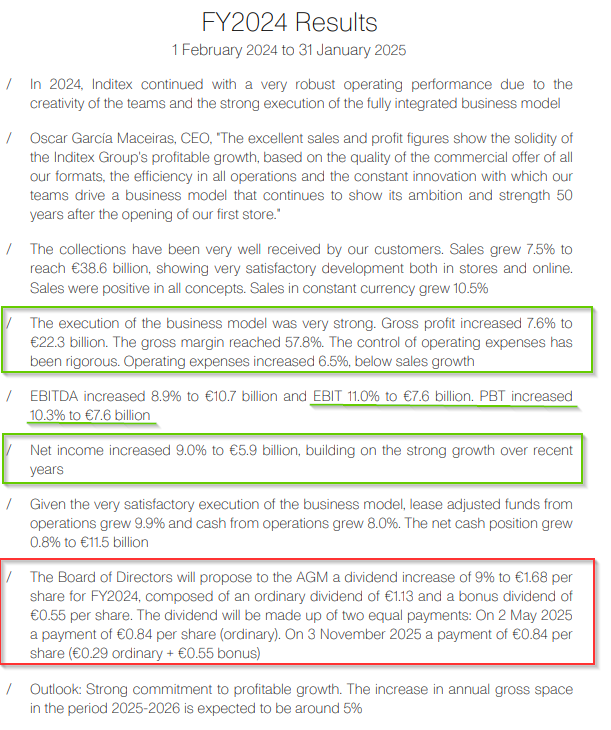

- “In what market is the company listed on?”

The answer will be:

- Spanish stock market (BME)

This is the main market and, as we have seen, it is advisable to always trade on the home market, as it offers greater liquidity and transparency.

However, this time the ticker does not appear, as it is not specified in the shared documents, so we must search for it manually.

Method 2: Manual search

As with Alphabet, we will see the two ways.

Method 2A - From Accounting

- We open the browser and search for “Inditex investor relations”.

- We access the first available link.

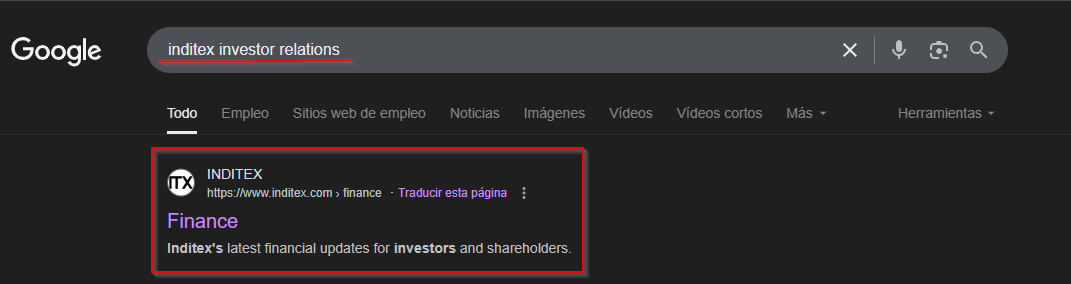

On the official page, scrolling down, we will find the chart where it indicates:

BME: ITX

- BME: Bolsas y Mercados Españoles (main market)

- ITX: Inditex ticker

Method 2B - From the search engine

If you type in the search engine, “Inditex Ticker”, you will get the following info:

Differences with the US market

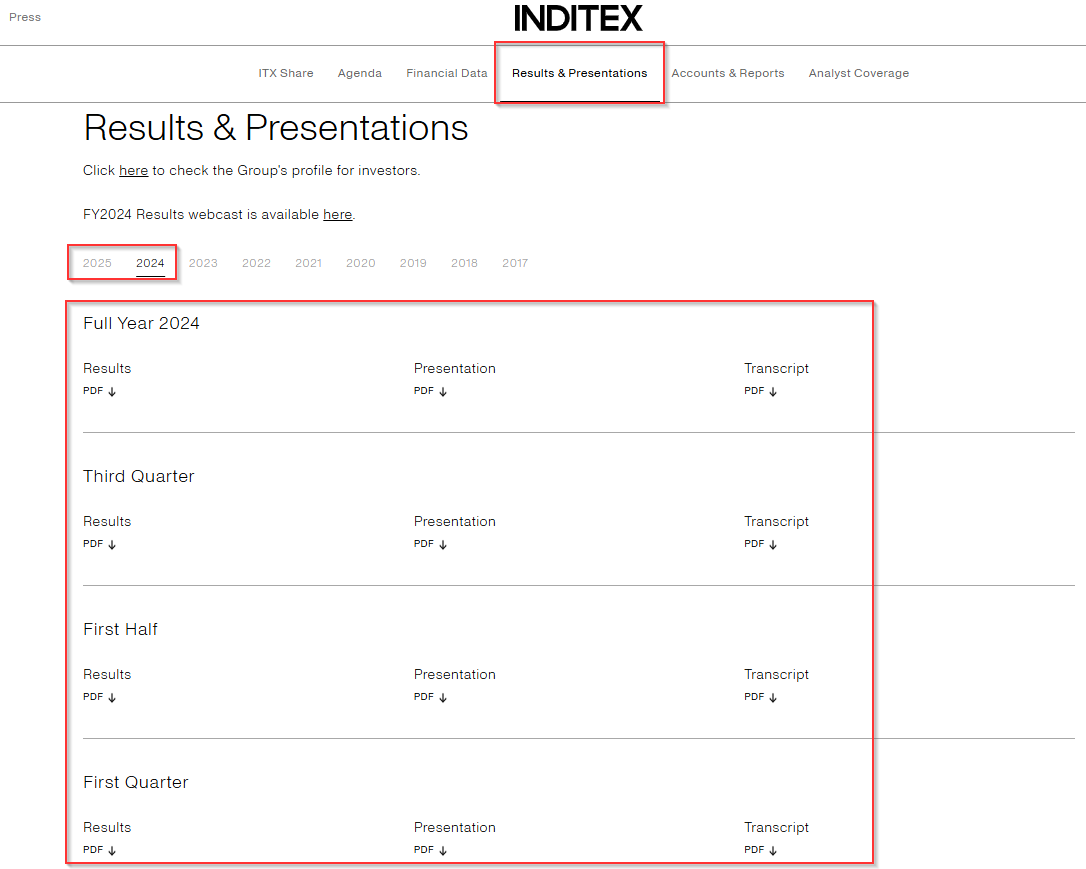

Unlike Alphabet, the website structure and reports are different, in Europe the results do not have the name 10-Q or 10-K.

Within the “Investor Relations” page, in the “Results and Presentations” section we will find the corresponding PDF files.

Another relevant difference is that Inditex does not have different share classes (Class A or Class C); all shares grant the same economic and political rights.

2. Is there any known fraud case in which the management team is involved?

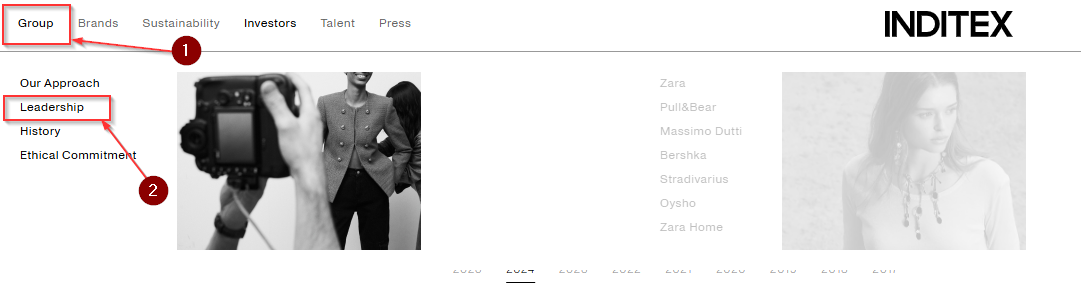

First, we need to identify who makes up the management team and check if any of its members are involved in lawsuits, frauds, or suspicious activities.

In this case, it is not necessary to resort to Notebook LM, as Inditex’s website presents it clearly and visually.

Method 2: Manual search - Management team

On the “Investor Relations” page, we access

- “Group –> Leadership”

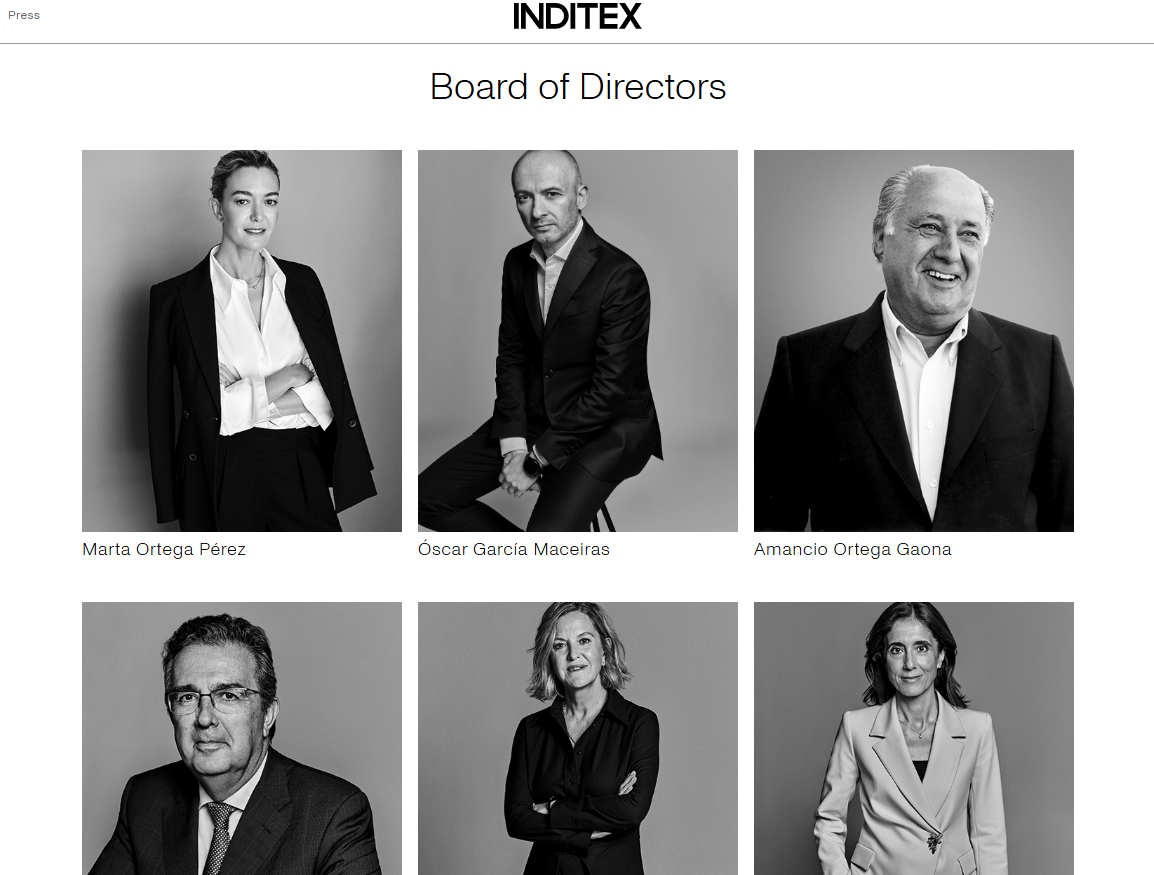

There we will find the list of the Board of Directors, with the name and photograph of each executive.

At the time of writing this document, the Board of Directors is composed of:

- Non-executive Chairwoman: Marta Ortega Pérez

- CEO: Oscar García Maceiras

- Founder and Board Member: Amancio Ortega Gaona

- Vice President and representative director of D. Amancio Ortega: José Arnau Sierra

- Representative director and spouse of D. Amancio Ortega: Flora Pérez Marcote

- Independent director: Pilar López Álvarez

- Independent director: José Luis Duran Schulz

- Independent director: Rodrigo Echenique Gordillo

- Independent director: Denise Patricia Kingsmill

- Independent director: Belén Romana García

Although it is simple to find the composition of the management team, analyzing it requires more work, as we must check each name individually.

Position definitions

Before analyzing possible backgrounds, let’s briefly clarify the positions:

- Non-executive Chairwoman: chairs the board of directors, but does not manage the day-to-day of the company.

- CEO: maximum responsible for daily management.

- Board Member: member of the board with voice and vote.

- Vice President: helps coordinate and supervise the board.

- Representative director: representative of a relevant shareholder.

- Independent director: member without personal or financial interests in the company, provides objectivity and impartiality.

Background verification

To analyze backgrounds, we search Google for the name and keywords such as “lawsuit”, “fraud”, “corruption” or “lawsuit”:

- “Name” (lawsuit OR fraud OR corruption OR lawsuit)

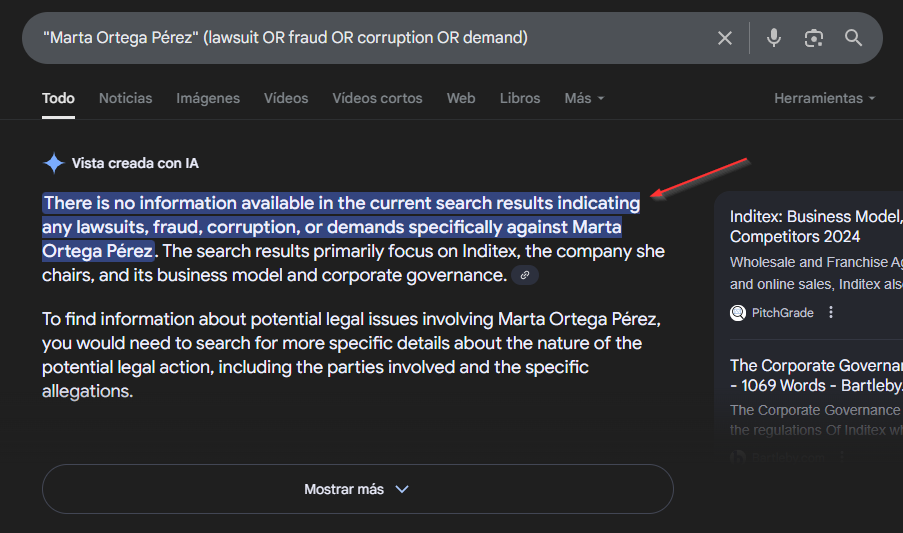

Marta Ortega Pérez

- “Marta Ortega Pérez” (lawsuit OR fraud OR corruption OR lawsuit)

Marta Ortega Pérez has no relevant background.

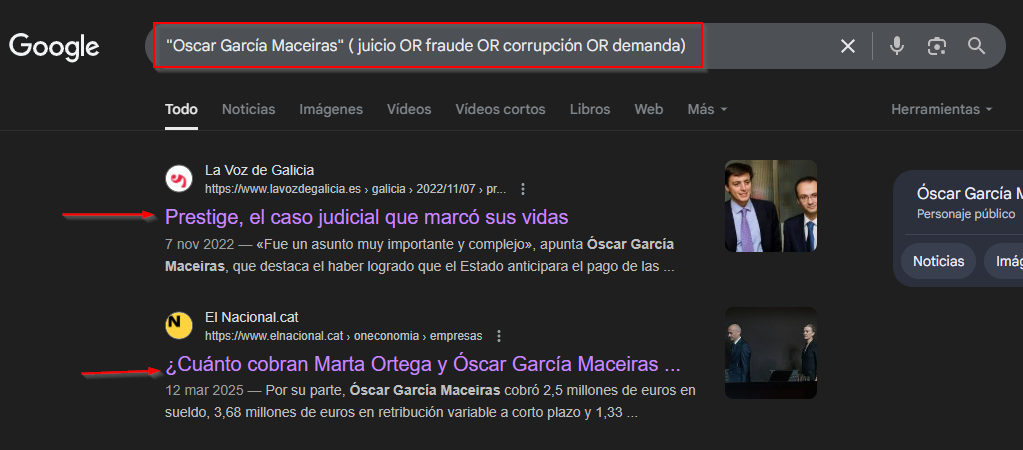

Oscar García Maceiras (CEO)

We can continue with the CEO, Oscar García Maceiras.

In English we will not find any “useful” info.

But in Spanish, we can see a couple of interesting articles.

When reviewing the search results, we observe that there are no news or articles that directly relate him to lawsuits, frauds, or illegal activities. This, in principle, is a positive sign.

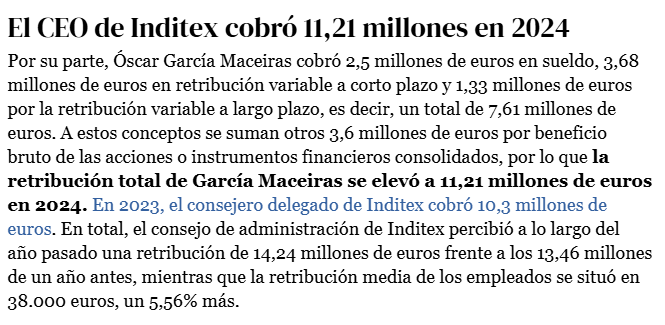

However, among the results appears an article that details the CEO’s remuneration in 2024.

Here a relevant question arises for the analysis:

- Is the CEO’s salary high, low, or reasonable compared to the sector?

Should this alert us as investors? The answer, as often happens in finance, is: it depends. The level of remuneration can be a gray area that should be analyzed in depth in the advanced phase, reviewing the accounting and comparing with other companies in the sector.

For now, we simply note it as an aspect to review later, since with the available information it is not possible to make a definitive judgment.

Just for comparison, Sundar Pichai (CEO of Alphabet), in 2024 earned 10.7 million.

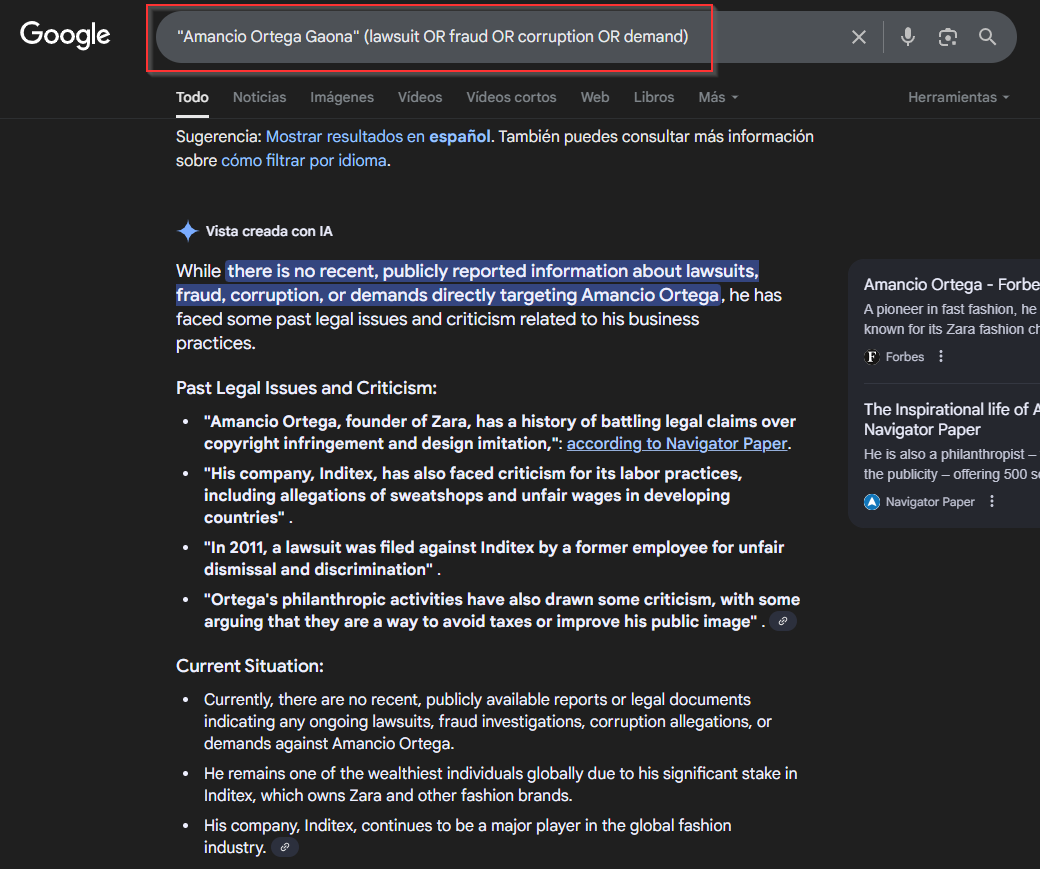

D. Amancio Ortega Gaona (Founder)

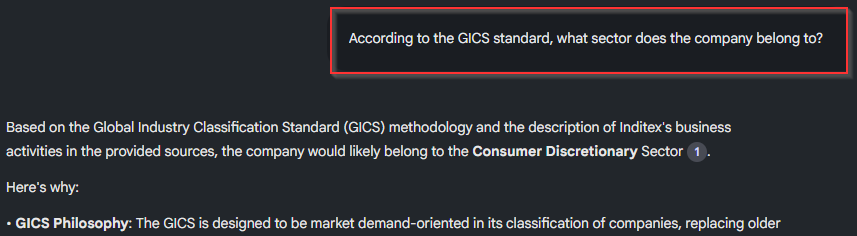

We continue with the next relevant team member: D. Amancio Ortega Gaona, founder of the company. A similar situation occurs here — the information in English is slightly different.

While if we look for it, in Spanish language:

According to the summary offered by Google, Amancio Ortega was sentenced by the Supreme Court to pay 33 million euros for non-payment of the Wealth Tax between 2001 and 2003.

- Does this represent an automatic red flag for shareholders?

In principle, no. It is a gray area: defrauding the tax authority implies a conflict with the State, not necessarily with shareholders and wealth generation.

However, it is important to note this fact and check in the advanced analysis that it does not affect the security of our investment.

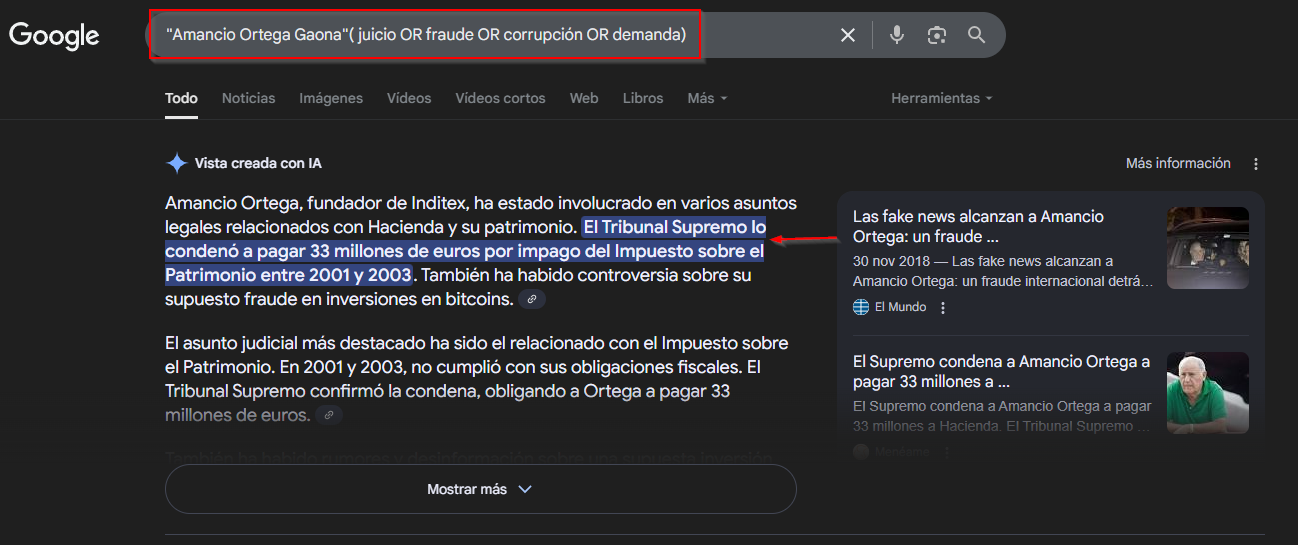

José Arnau Sierra (Vice President)

We continue, José Arnau Sierra, vice president and representative director.

We don’t have any strange article against Jose Arnau Sierra.

Conclusion of the management team analysis

As you can see, the analysis of Inditex’s management team, although easier to locate than in other companies, requires considerable effort to rule out possible risks, simply because it has a larger administrative team.

That is why, following the rule established at the beginning of the analysis, this additional effort is only justified if the potential profitability of the company equals or exceeds that of other simpler options to analyze.

I encourage you, if you are interested, to continue investigating the rest of the directors applying the same methodology. Now, let’s continue with point number 3.

3. Is the company part of my circle of competence?

First, we will identify what sector the company belongs to and then analyze how it generates profits. This will allow us to better understand the overall picture.

3A - What sector does the company belong to?

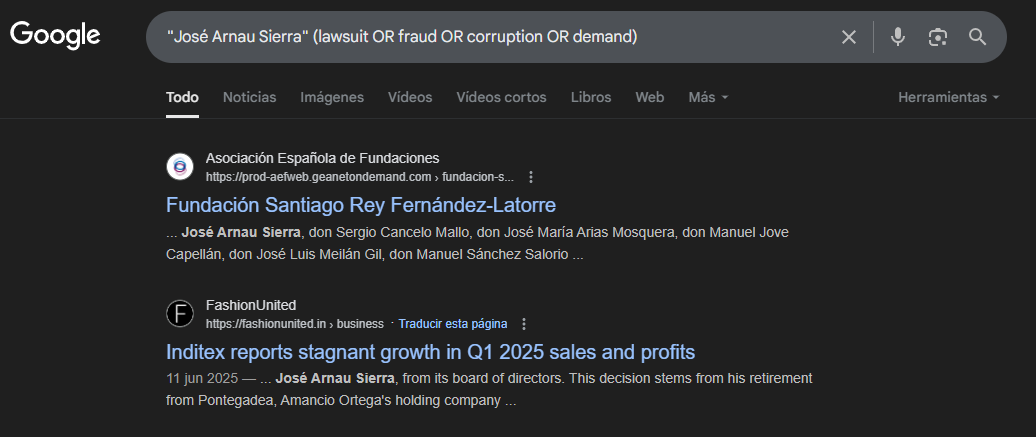

We can ask Notebook LM:

- “According to the GICS standard, what sector does the company belong to?”

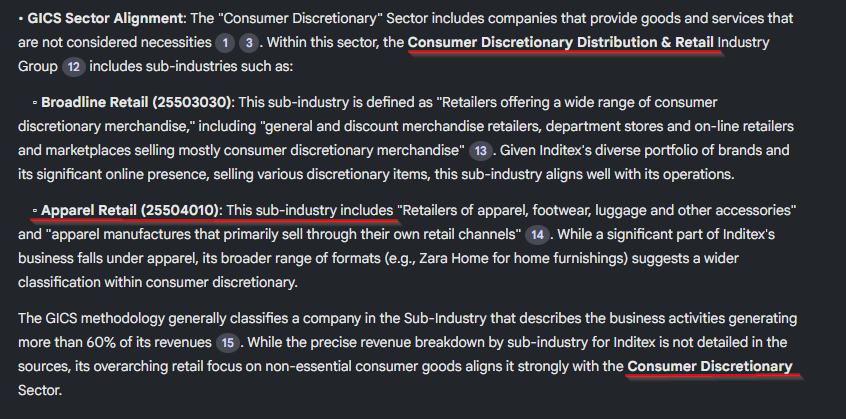

The answer will be that, according to the GICS standard, Inditex is classified in:

- Consumer Discretionary Sector and in the Apparel Retail subindustry (Apparel retail).

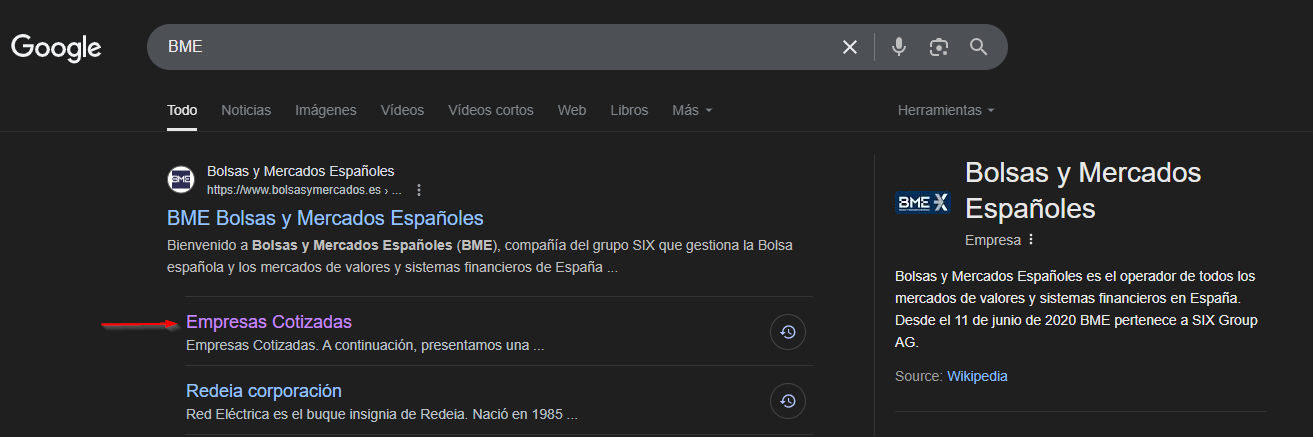

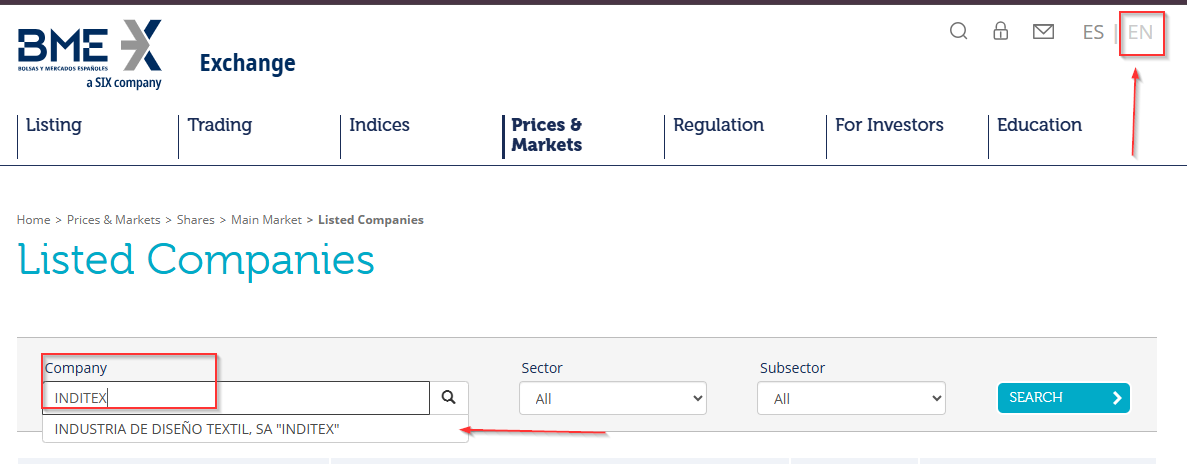

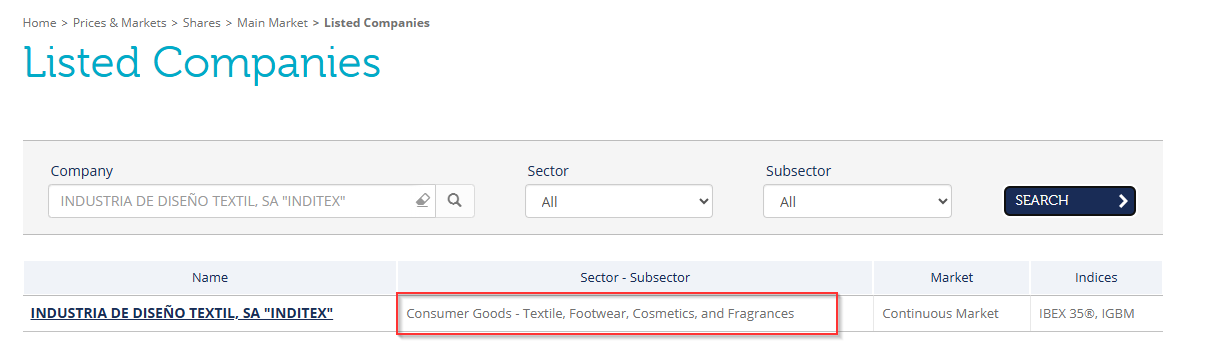

Sector according to BME

We access the BME website:

We search for Inditex and verify that it belongs to the Consumer Goods sector.

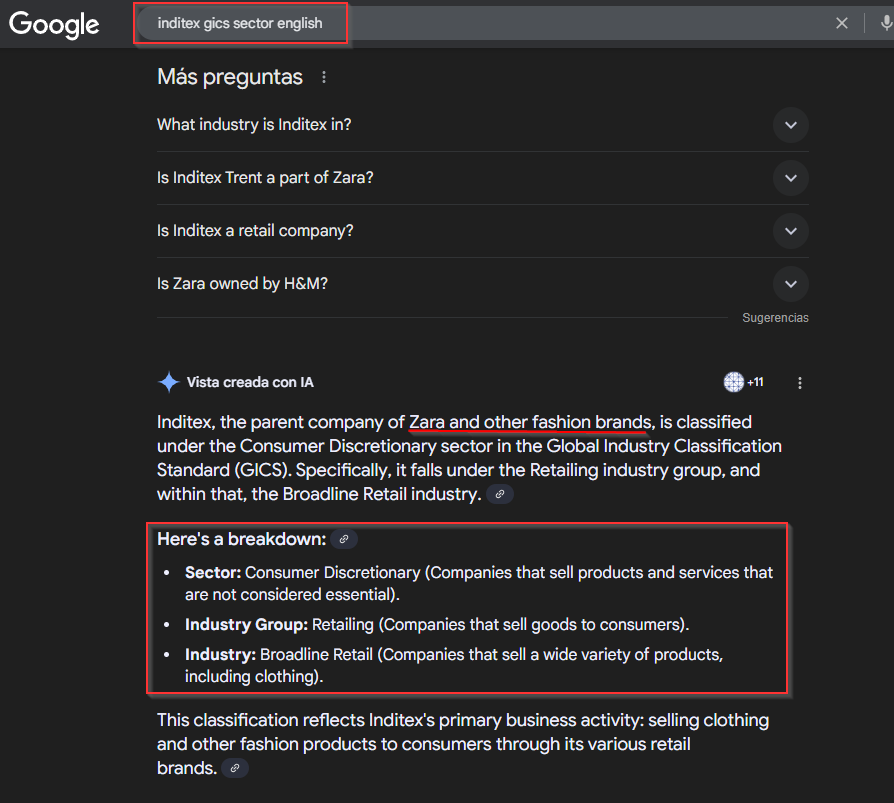

Manual search of the sector according to GICS

As with Alphabet, to do it rigorously you would have to review the accounting and see which revenue line exceeds 60%.

Alternatively, we can search the internet:

- “Inditex GICS”

- “Inditex GICS sector english”

In summary, Inditex is positioned in:

- Sector: Consumer Goods

- Subsector: Apparel retail

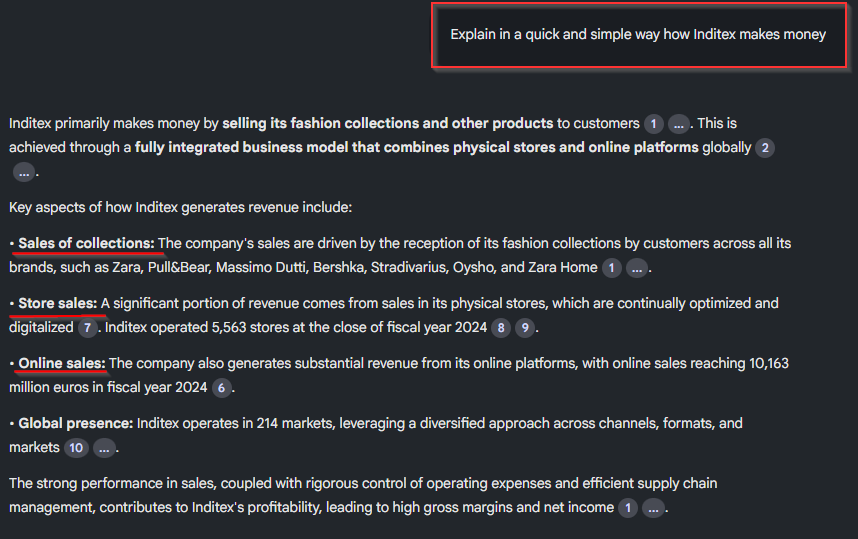

3B - How does it make money?

We can ask Notebook LM:

- “Explain in a quick and simple way how Inditex makes money”

The answer will be that the company sells fashion products through the internet and physical stores, with different brands and formats such as Bershka, Stradivarius, Zara, Pull&Bear, among others.

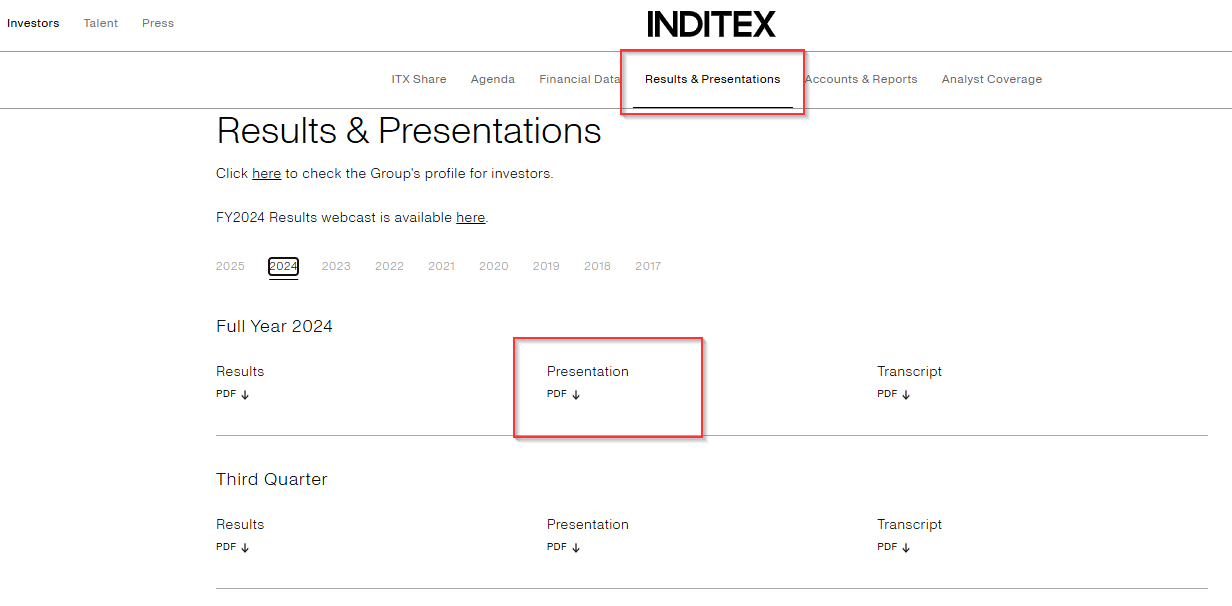

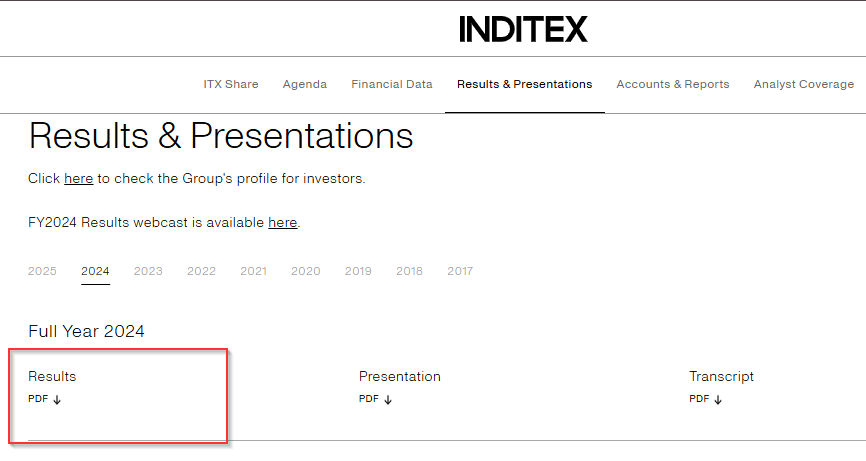

Information verification

How do we make sure that artificial intelligence has answered us correctly?

To ensure veracity, we must read the results presentation available on the company’s website, in the “Results and Presentations” section.

4. Quick accounting valuation

In Europe, the metrics equivalent to US GAAP are NIIF (Normas Internacionales de Información Financiera) or in English IFRS, adopted by the European Union.

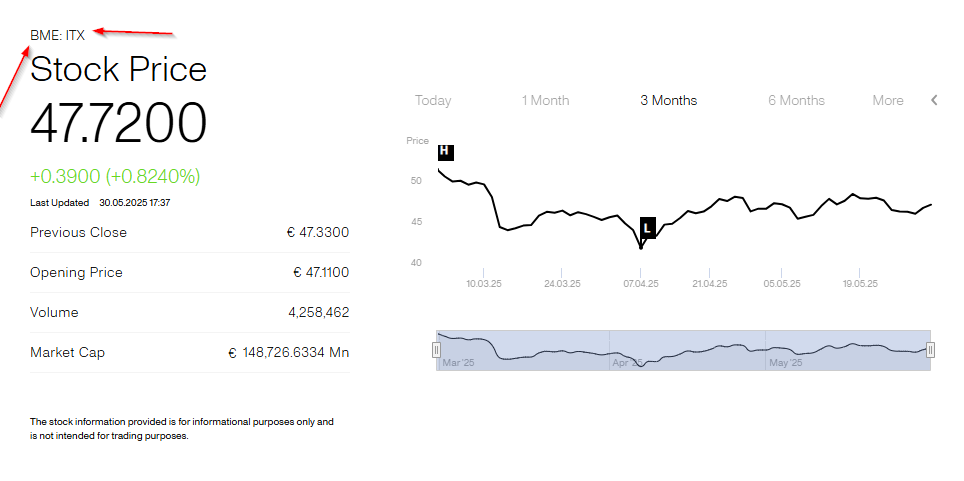

Taking this into account, let’s review the PDF file – “Results”:

Audited vs non-audited metrics

When analyzing results, we should trust audited metrics (marked in green) and be cautious with non-audited or unverifiable statements (marked in red). EBITDA, for example, is not a standard IFRS metric, so it should be analyzed with caution.

About dividends

Beware of dividend increases, it is positive when the company generates a lot of money and cannot reinvest it, but dividends are subject to taxation (around 20%).

As shareholders, we will always prefer that money be reinvested to generate more wealth, unless the company no longer has room for growth.

Results

As we can see in the following image, they have had growth in both gross margin and profits.

Inditex’s board also approved a dividend increase, it’s not a bad thing per se, but as I mentioned in the previous point, the dividend does not generate value.

Doing a quick check we see that it has positive points, but some of them not so many.