Alphabet

Introduction

We will begin with Alphabet, the parent company of Google, Fiber, Calico, Google Ventures, Nest, among others.

We will analyze how to answer the questions posed in the previous section:

- What market does it trade on?

- Is there any known fraud case in which the management team is involved?

- Is the company part of my circle of competence?

- Quick accounting valuation

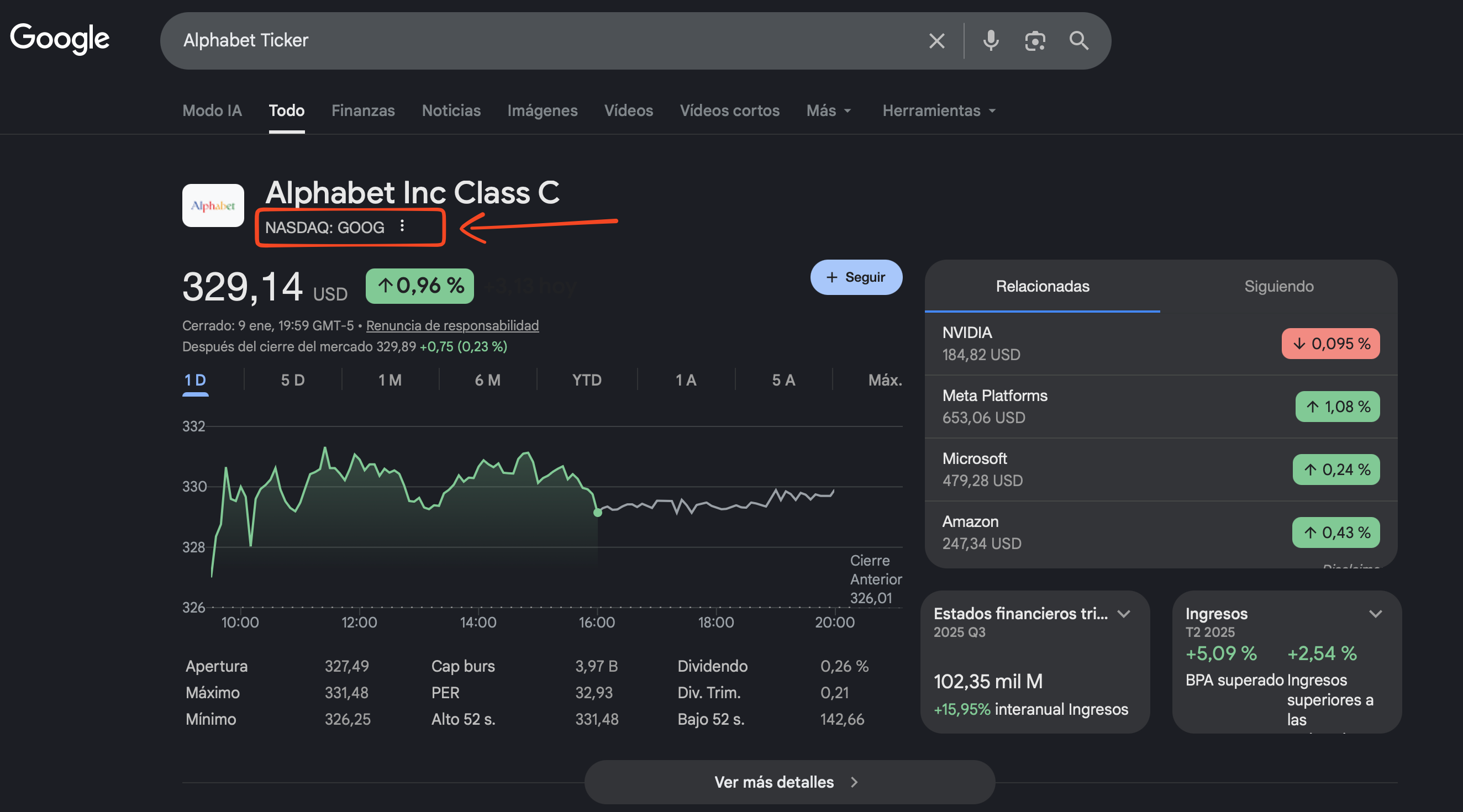

1. What market does it trade on?

We are interested in identifying the main market where the company’s stock symbol (ticker) is traded. Although a stock can be listed on different exchanges, there is usually a main market where most of the trading volume is concentrated.

Example:

- GOOGL (Alphabet’s ticker), its main market is NASDAQ, in the United States.

- ABEA.DE (Alphabet’s ticker on the German stock exchange).

Frequently asked questions

If we make the purchase on a non-primary market, are we buying the same company or different companies?

We are buying shares of the same company, but on a different market.Where is it better to buy, on the home market or on foreign exchanges?

We should ALWAYS trade on the home exchange. This offers advantages such as:- Higher trading volume

- Prices closer to intrinsic value

- Lower currency exchange risk

- Access to more accurate and, sometimes, faster information

Next, we will see three methods of how to find the main market where a company trades.

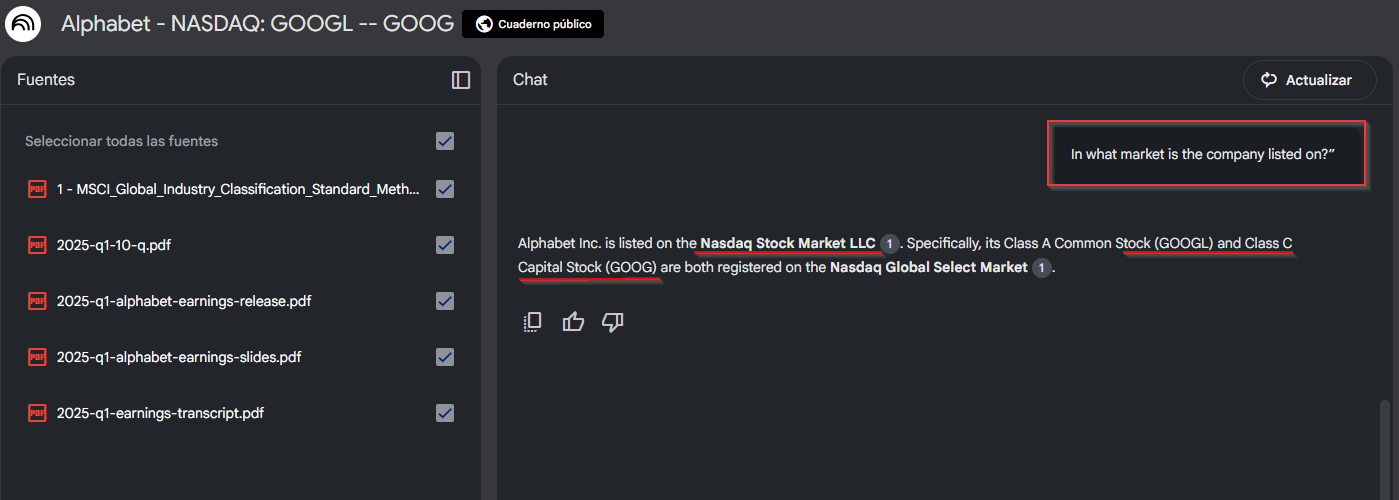

Method 1: Using Notebook LM

- NotebookLM folder link: https://notebooklm.google.com/notebook/58665d02-41fe-4015-8235-21a9e2455a50

If you decide to use the Notebook LM tool, remember to have the corresponding files (10-K or 10-Q), when you have them, ask it directly:

- “In what market is the company listed on?”

The answer we will get will be:

- Market: NASDAQ

- Tickers: GOOGL and GOOG.

Method 2: Manual search

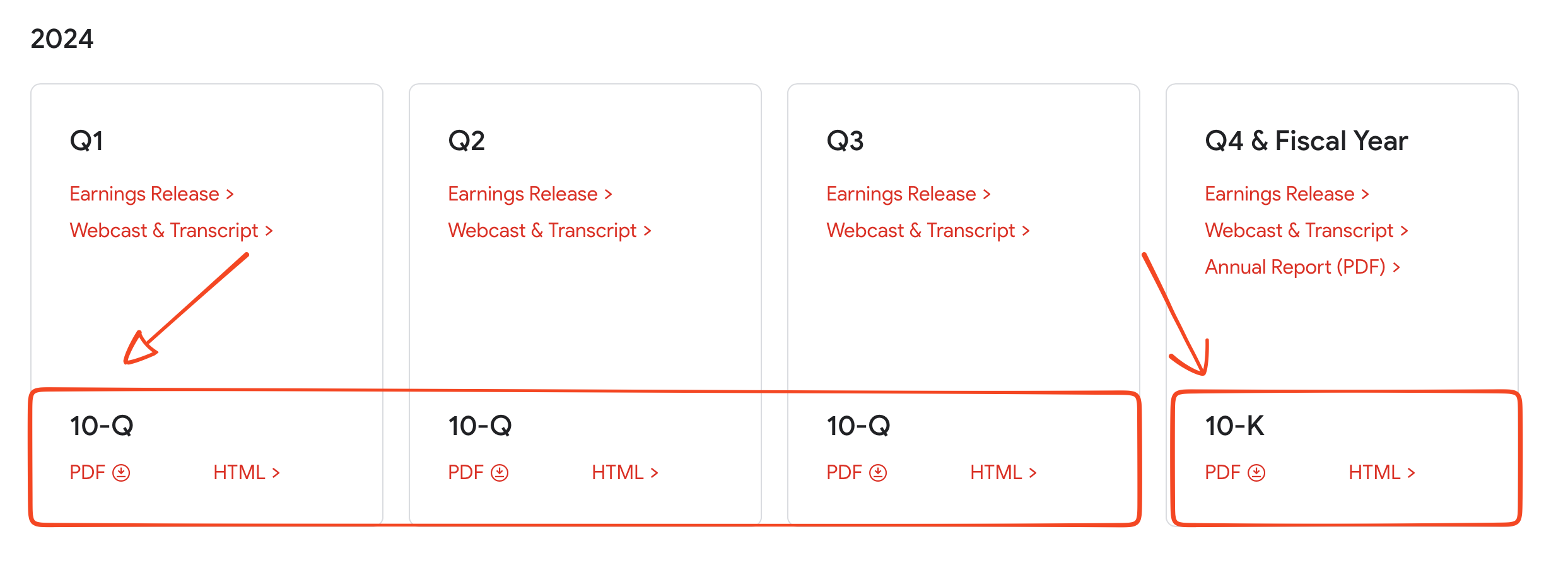

There are two ways to do it, the first and “longer” one, reviewing the accounting files (Method 2A), the second described in Method 2B, searching for the ticker.

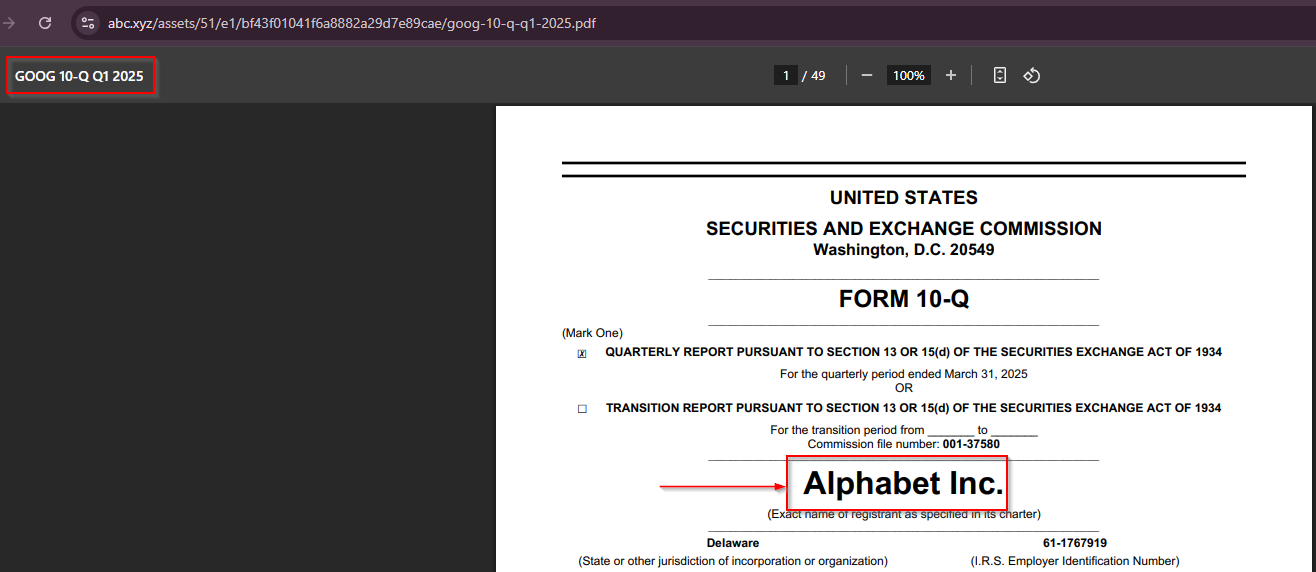

Method 2A - From Accounting

- We open our browser and search for: “Alphabet investor relations”.

- We click on the first link that Google shows us.

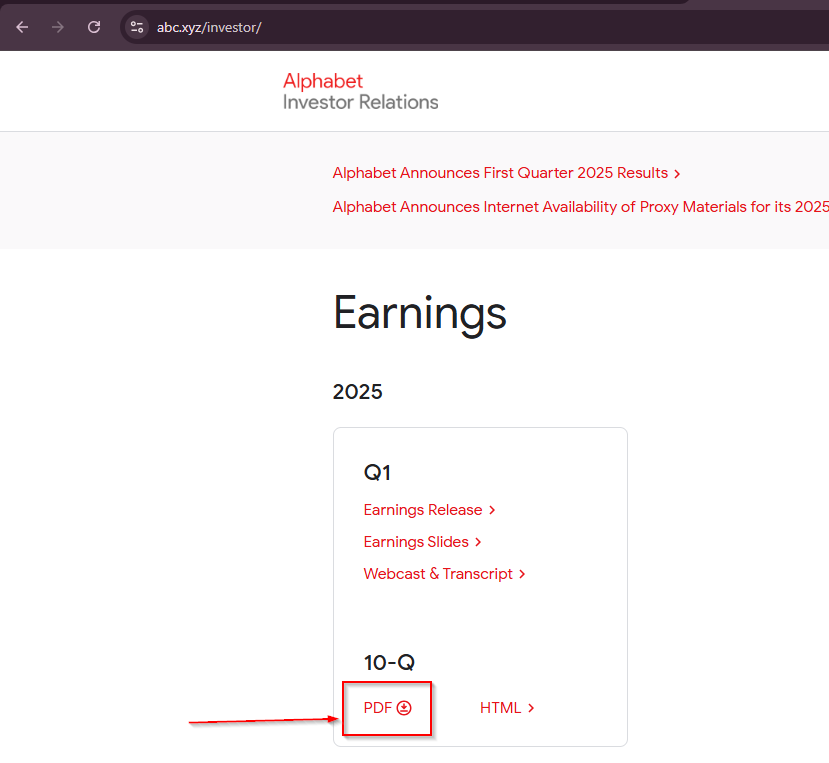

What interests us is the PDF file, regardless of the year or quarter.

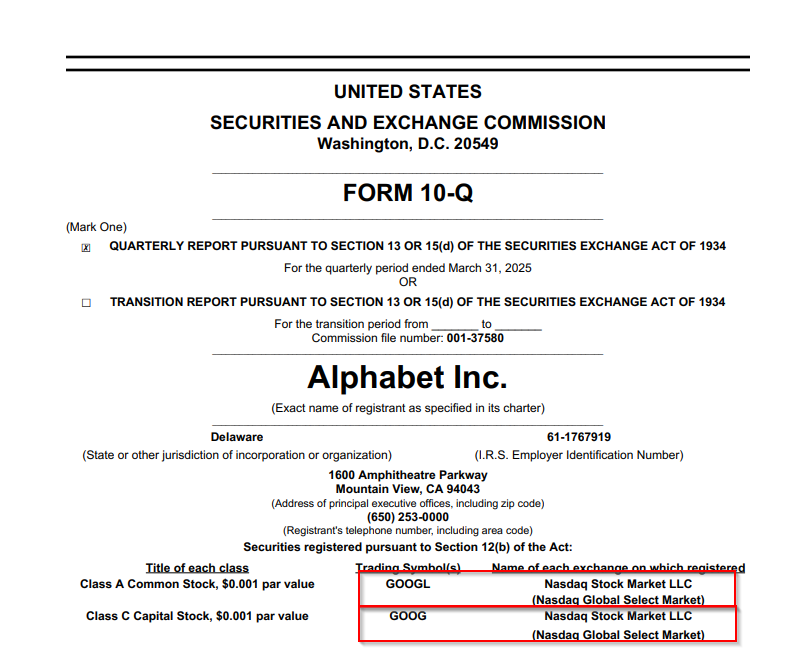

When accessing the PDF section, we will see the following information:

Alphabet has two tickers: GOOGL and GOOG, both trade on NASDAQ.

- What is the difference between GOOGL and GOOG?

- GOOGL is Class A (with voting rights)

- GOOG is Class C (without voting rights)

Having voting rights means being able to participate in company decisions, which usually translates into a higher cost per share. This differentiation between share classes also exists in other companies, it’s not exclusive to Alphabet.

Method 2B - From the search engine

If you type in the search engine, “Alphabet Ticker”, you will get the following info:

Financial documents in the United States

Before continuing, I want to comment on a couple of peculiarities about document presentation in the United States.

You will normally see the following sections:

- 10-Q – Quarterly reports (three per year)

- 10-K – Annual report (one per year)

In total, you will have four documents per year that will indicate the company’s evolution.

Is it good to have so much information? Of course, the more information we handle, the better we can anticipate possible relevant events for the company.

In Europe, the practice is different and we will need to adapt to each country and company, as we will see later with Inditex.

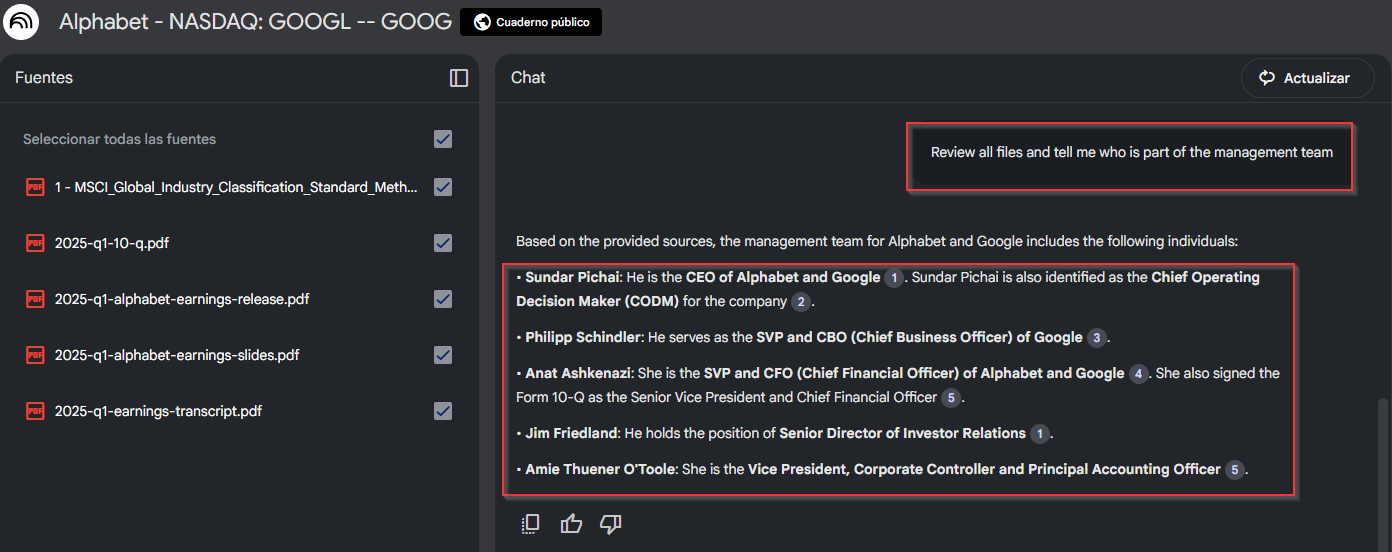

2. Is there any known fraud case in which the management team is involved?

The main objective of this point is to identify who makes up the management team and check if they are not involved in lawsuits, frauds, or other suspicious activities that could affect shareholders.

First, we need to know who is part of the management team, for this we can use tools like Notebook LM, but the background check should be done manually.

Method 1: Notebook LM - Management team

Open the Alphabet folder in Notebook LM, and ask:

- “Review all files and tell me who is part of the management team”

The results will be the following:

- Sundar Pichai: CEO of Alphabet and Google

- Anat Ashkenazi: SVP and CFO of Alphabet and Google

- Philipp Schindler: SVP and CBO of Google

- Jim Friedland: Senior Director of Investor Relations

- Amie Thuener O’Toole: Vice President, Corporate Controller and Principal Accounting Officer

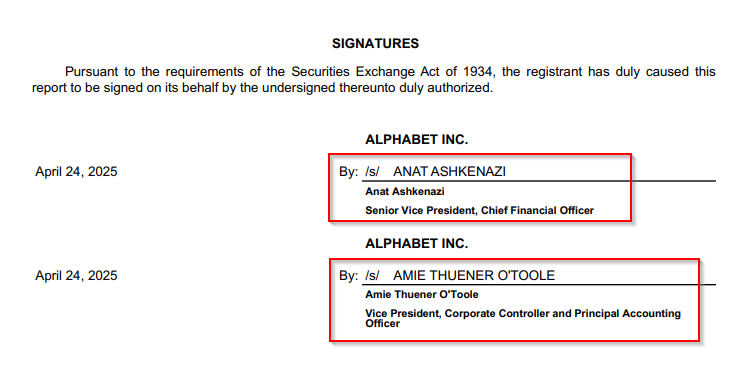

Method 2: Manual search - Management team

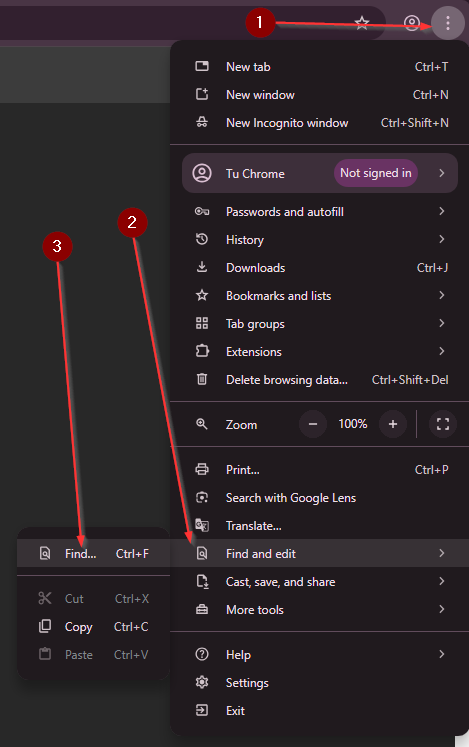

To do it manually:

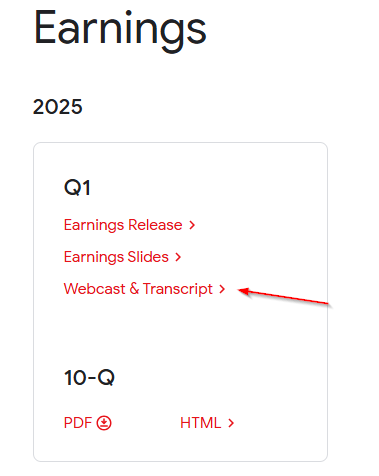

- We access Alphabet’s “Investor Relations” page and search for the 10-Q PDF file.

- At the bottom we will find the names of the executives.

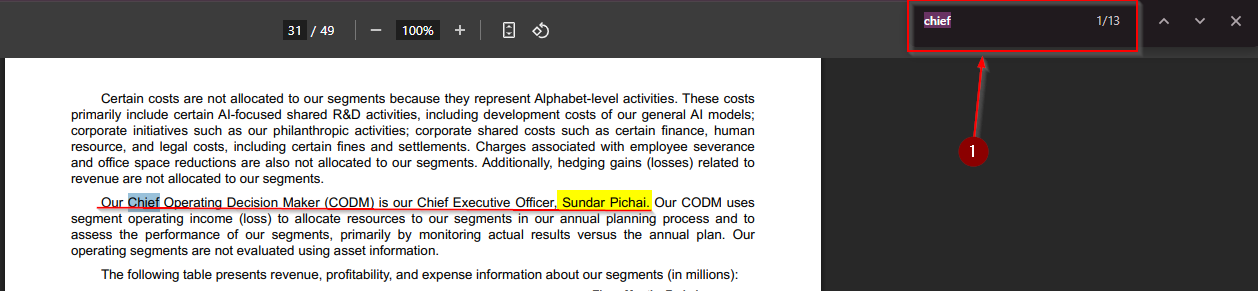

- To find the CEO, we use the search function (Ctrl+F) in the document and search for “CEO” or “Chief” to locate the executives.

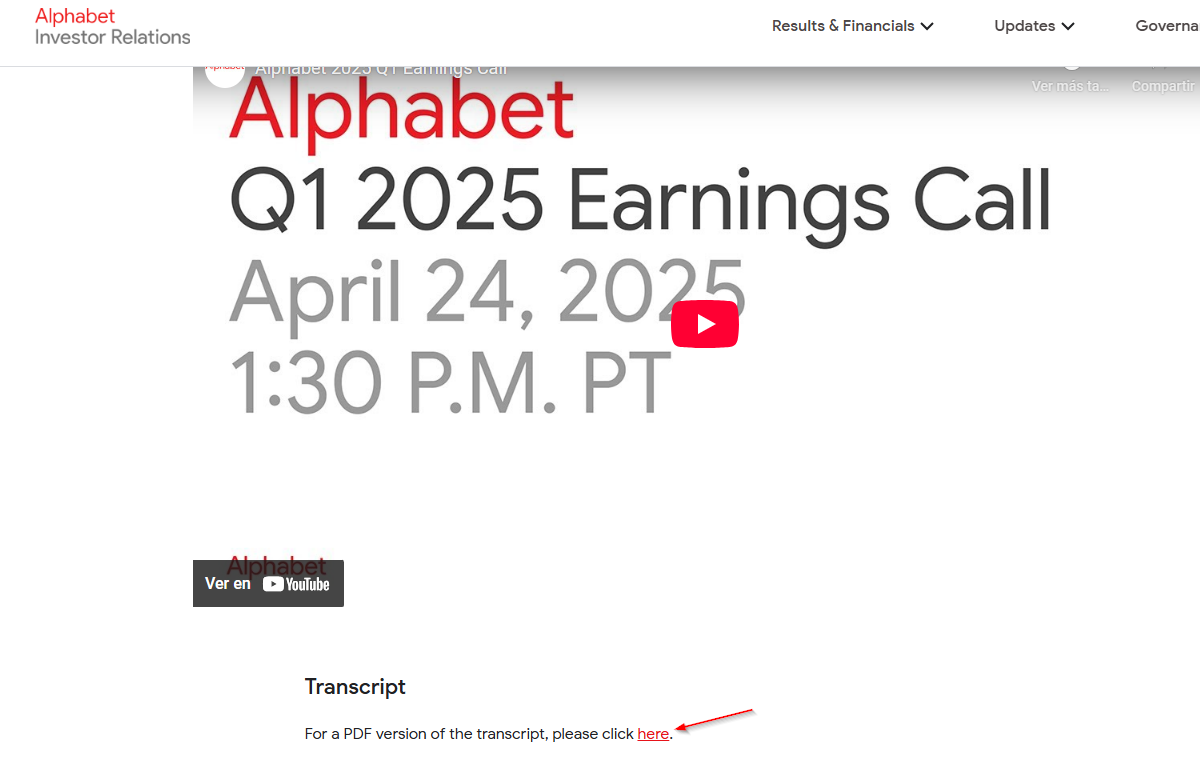

Finally, we review the transcript file of the call with investors that Google attaches. Use the search function again to locate the relevant names and positions.

Then click on the PDF file option, “here” button (translated to Spanish, aquí)

In summary, these are the main members of the management team:

- CEO: Sundar Pichai

- CFO: Anat Ashkenazi

- Vice President, Corporate Controller and Principal Accounting Officer: Amie Thuener O’Toole

- SVP and CBO of Google: Philipp Schindler

- Senior Director of Investor Relations: Jim Friedland

Background verification

A small tip, try to search for information in the language of where the company’s headquarters is located. It will have more media coverage, but don’t worry too much, if a publicly traded company commits fraud, it usually appears in media worldwide.

- Example: English company - Ted Baker - “luxury” clothing

We continue with Alphabet, let’s check if the names of its executives appear on the internet associated with terms like “fraud”, “lawsuit”, “corruption” or “lawsuit”.

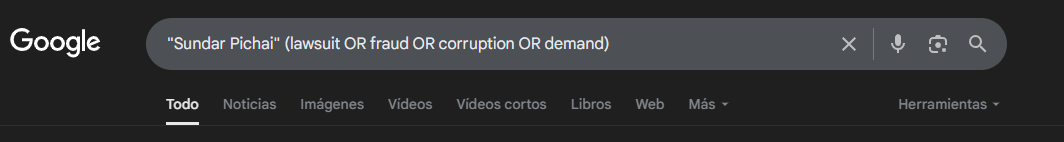

Sundar Pichai

We search Google for the full name along with keywords, for example:

- “Sundar Pichai” (lawsuit OR fraud OR corruption OR lawsuit)

The first thing we observe, just by reading the headlines, is that the accusations are directed at Google as a company, and not at Sundar Pichai as an individual. If we delve into the news, we will see that the CEO will appear on behalf of Google before the court.

Is this a negative sign? Not necessarily for Sundar Pichai as an individual, although it could have implications for the company we are analyzing. If we review the content of the news, the lawsuit is related to monopoly issues, which, although it may seem contradictory, can be interpreted as a point in favor, as it shows that the company has a relevant competitive advantage.

Is there a risk that Google will go bankrupt if it loses the lawsuit? The probability of this happening is practically nil; later, when reviewing the accounting, we will be able to confirm this.

With this simple check, we see that Sundar Pichai does not appear to be involved in any case of corruption or fraud.

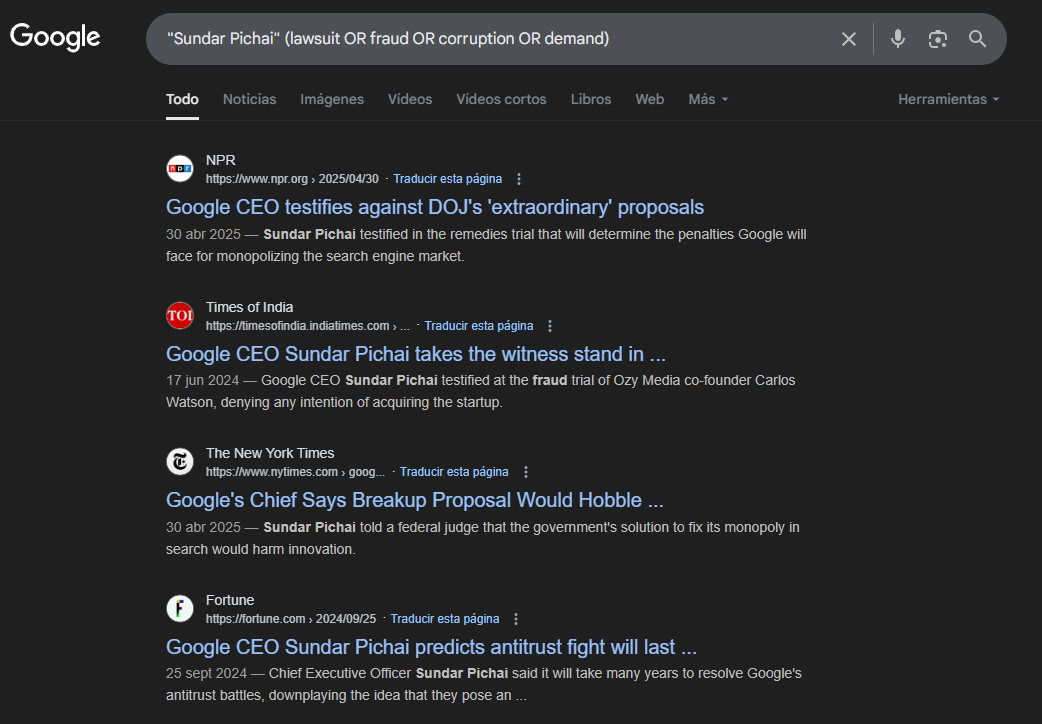

Anat Ashkenazi (CFO)

- “Anat Ashkenazi” (lawsuit OR fraud OR corruption OR lawsuit)

We verify that she is also not involved in any relevant matter.

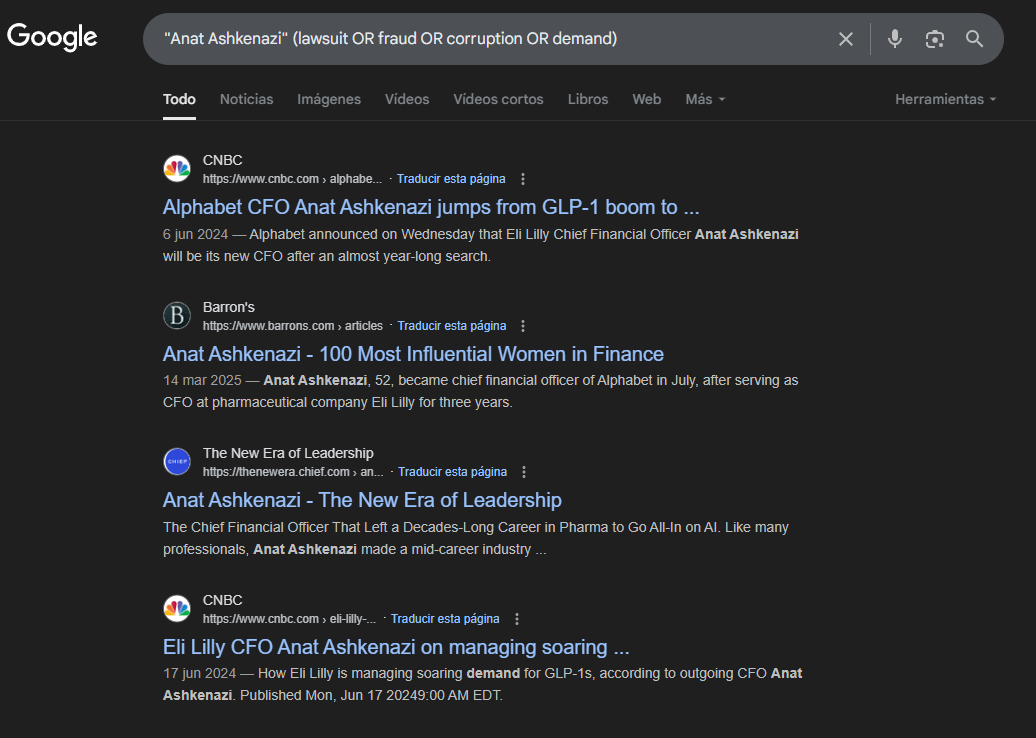

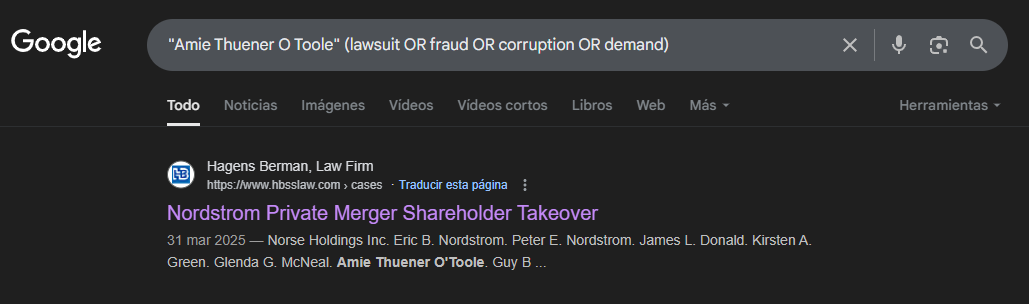

Amie Thuener O’Toole (Vice President)

- “Amie Thuener O’Toole” (lawsuit OR fraud OR corruption OR lawsuit)

What’s interesting about Amie is that, if we search for information in Spanish, no news appears,

but if we do it in English, the local language of Alphabet (United States), we find the following:

An article appears about a class action lawsuit involving other directors and executives of Nordstrom, related to an alleged unfair private merger. They are accused of harming minority shareholders by offering a low price and carrying out a non-transparent process.

Question 1 – What position does Amie hold at Nordstrom?

She acts as an independent director, which means she does not work directly for the company nor does she have personal financial interests in it.

Question 2 – Is this serious enough to rule out investing in Alphabet?

The alleged irregularities were committed by Nordstrom’s executive team. At no time is Amie pointed out as directly responsible. In addition, there are no indications that something similar is happening at Alphabet.

In fact, for greater peace of mind: Alphabet, being an international company with great social impact, is subject to strict regulation and constant monitoring by numerous analysts. If something like this happened, it would be known almost immediately.

From my point of view, this article mainly affects Amie’s reputation, not Alphabet. However, it would be prudent to closely follow the development of this class action lawsuit to see how it concludes.

Philipp Schindler

Next on the list is Philipp Schindler, There was a lawsuit filed against him in 2017, but there isn’t much information available. In 2018, Judge Ivan L.R. Lemelle granted the motion to dismiss, and the case was dismissed with prejudice.

Jim Friedland

Finally, Jim Friedland, about whom no incidents appear either.

Conclusion of the management team analysis

In summary, we have verified that the management team (of Alphabet) is not involved in any known scheme, which is a positive point and allows us to continue with the next section of the analysis.

All names were checked in both languages and the important part has been highlighted, as of August 2024.

Languages: Spanish and English (local language of Alphabet).

3. Is the company part of my circle of competence?

At this point, artificial intelligence can save us a lot of work. It is no longer necessary to read extensive documents to understand the business; just find the right document and consult it with AI.

The files used were the PDFs from Alphabet Investor Relations and the GICS definition made by MSCI.

We open our Alphabet folder in Notebook LM and begin searching for the answer to our questions.

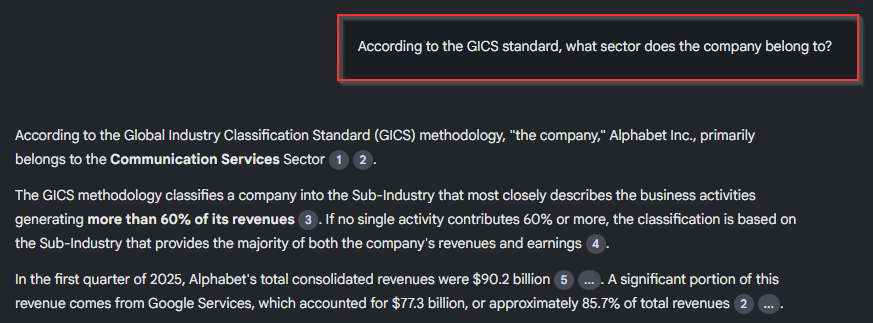

3A - What sector does the company belong to?

In the folder we will also find the MSCI file that describes GICS, so we can ask the following question:

- “According to the GICS standard, what sector does the company belong to?”

We will get a complete reasoning of why the company is in that specific sector:

- Communication Services Sector, aligned with the Interactive Media and Services subindustry

As I mentioned in the initiation notes, there is no universal official terminology; each analyst follows their own criteria. My advice is to use GICS, which for me is the best form of sector categorization.

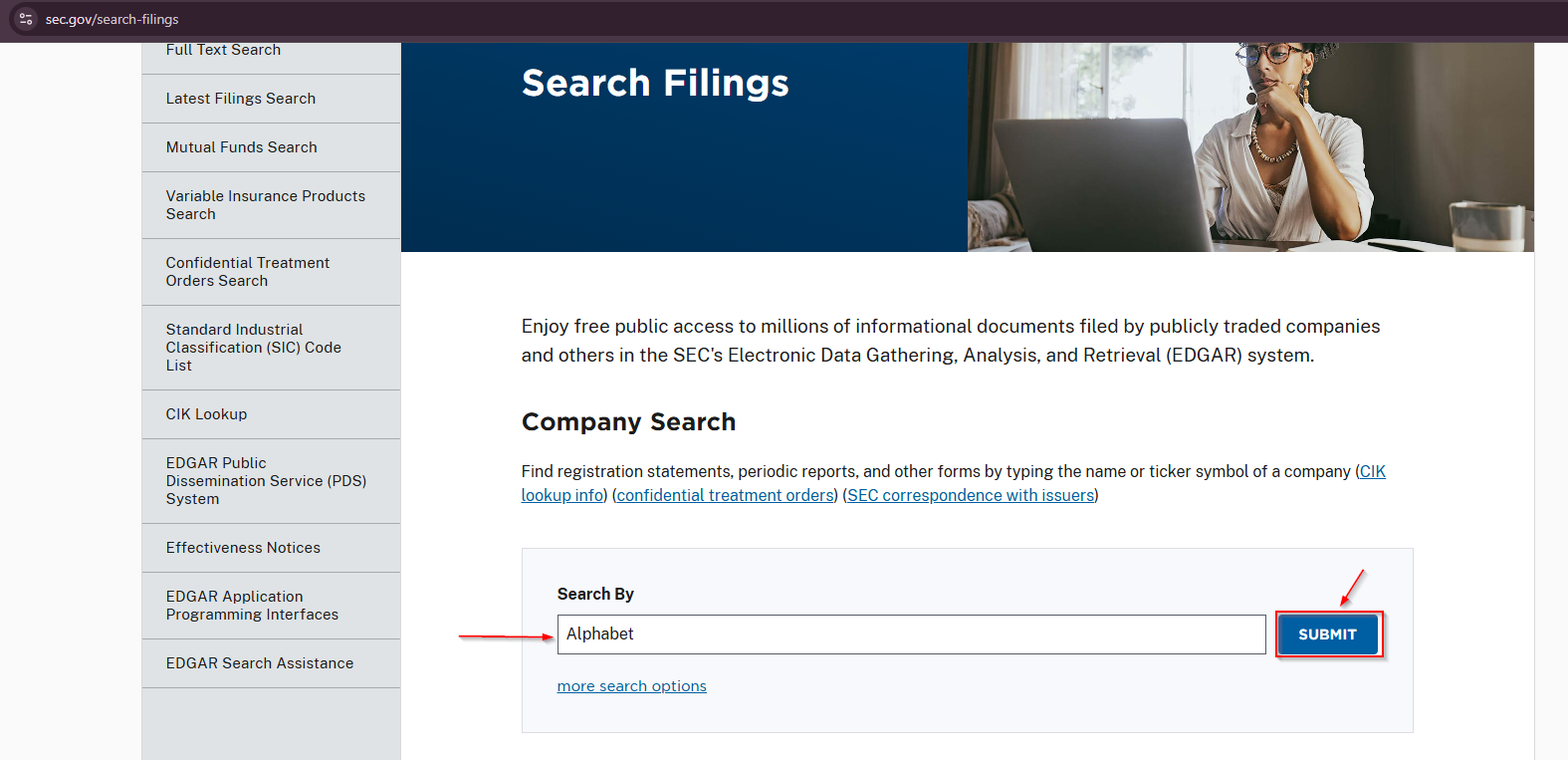

Sector according to the SEC

If you want to check the sector as it appears in the SEC (Securities and Exchange Commission), the regulator of the financial markets in the United States.

Go to their website:

Once inside, in the search box we enter “Alphabet” and click “Submit”.

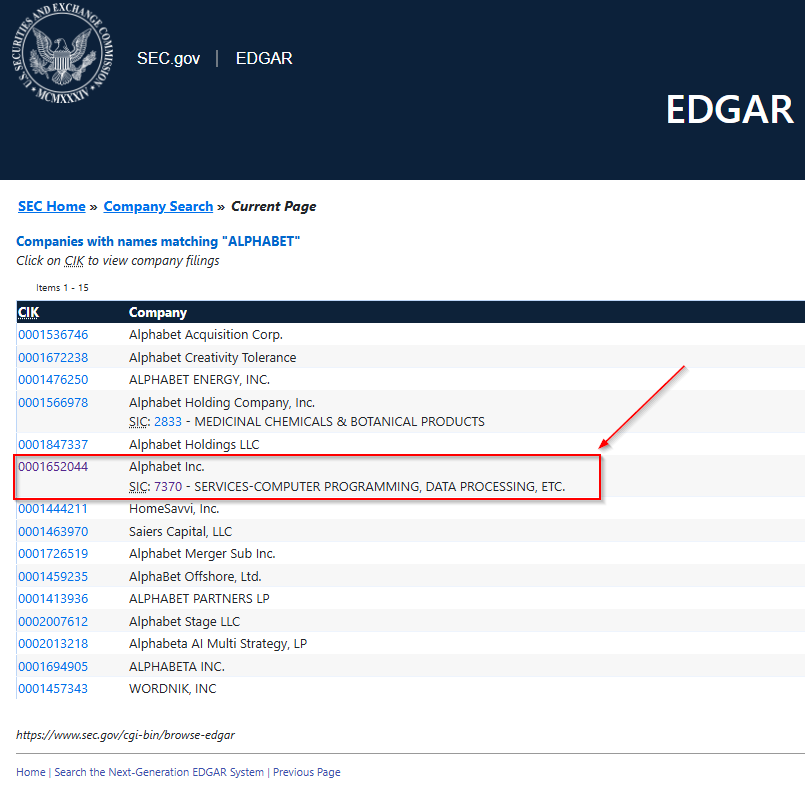

We are interested in the following part:

As can be seen, the SEC’s SIC system has marked Alphabet with code 7370, which corresponds to SERVICES – COMPUTER PROGRAMMING, DATA PROCESSING, ETC.

Both the GICS standard and the SEC place Alphabet in the services industry, although GICS does it more specifically: Communication Services Sector.

How do we know we are analyzing the correct company in the SEC list?

We must go to the company’s 10-Q PDF.

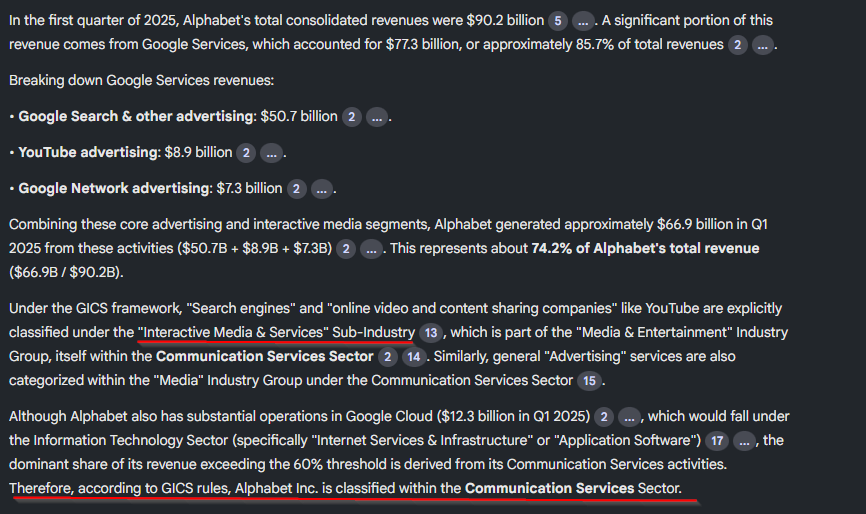

Manual search of the sector according to GICS

It’s fine to ask artificial intelligence, but what if for some reason you couldn’t do it?

To do it really manually, you would have to review the accounting and analyze how the company makes money. All revenue lines are compared and the one that exceeds 60% is used for sector classification.

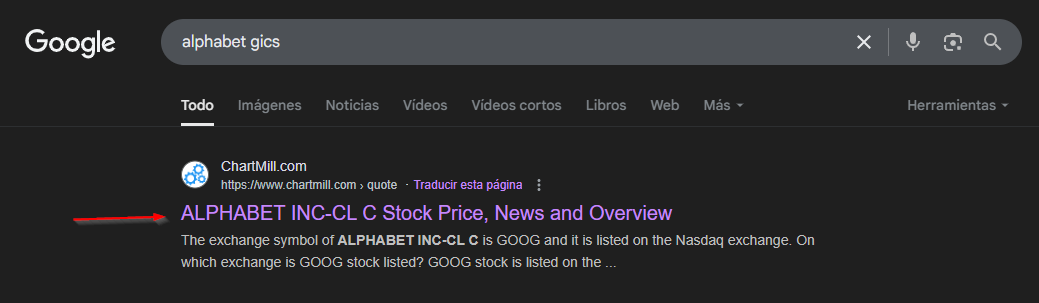

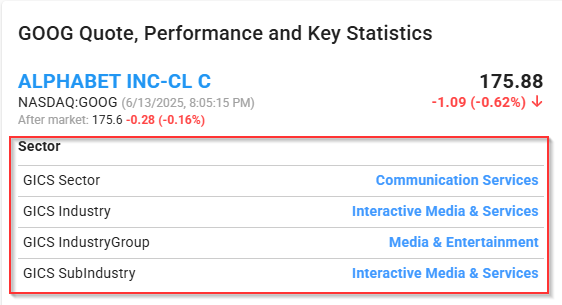

It can also be done more quickly by searching the internet:

- “Alphabet GICS”

In this “semi-manual” way we can verify that Notebook LM has correctly reasoned the sector and subsector.

In summary, Alphabet is positioned in:

- Sector: Communication Services

- Subsector: Interactive Media and Services

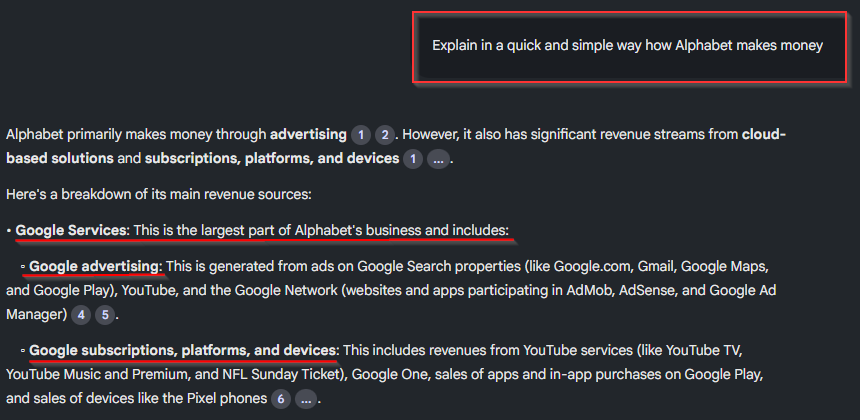

3B - How does it make money?

The easiest and fastest way is to use the Notebook LM tool and ask it:

- “Explain to me in a quick and simple way how Alphabet makes money”

I recommend that everyone read the information, but here’s a summary:

Digital Advertising

- Ads on Google Search

- Ads on YouTube

- Ads on Google Network

Cloud Computing (Google Cloud)

Subscriptions, platforms and devices

- Subscription services: YouTube TV, YouTube Music and Premium, etc.

- App sales and in-app purchases on Google Play

- Physical device sales

Other Bets: Healthcare services and internet services

Information verification

How do we make sure that artificial intelligence has answered us correctly?

Here, ideally we should go to the official reports, 10-Q or 10-K. It can also be complemented with the transcript of the analysts’ call with the management team.

4. Quick accounting valuation

Given that most people are not yet familiar with the basic concepts of accounting, I have decided not to mention Koyfin which includes useful metrics for this type of valuation, and I have preferred to teach with an example, the importance of always using GAAP values - official and regulated values.

Go to the “Investor Relations” page and, instead of 10-Q, review the “Earning Release” and “Earning Slides” section.

The 10-Q contains the same accounting data, but in “Earning Slides” and “Earning Release” the presentation is more visual and comfortable.

GAAP vs NON-GAAP Metrics

When opening the “Earning Slides”, on the second page we see the following:

We are informed that GAAP and NON-GAAP metrics have been used in the presentation.

- GAAP Metric: is a standard, regulated metric, whose manipulation can lead to significant sanctions by regulatory authorities.

- NON-GAAP: non-standard metrics, the company can select whatever formula it wants for the calculation.

We should ALWAYS pay attention to GAAP data, as they reflect the reality of the company.

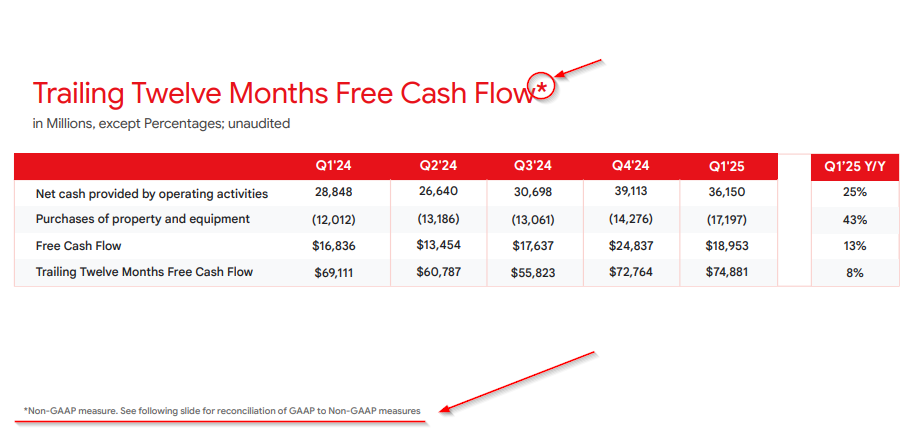

How do we know what is a GAAP metric and what is NON-GAAP?

Alphabet, for our convenience, clearly marks NON-GAAP metrics to facilitate analysis, or in other companies, NON-GAAP metrics usually have the prefix or suffix “Adjusted”.

Results analysis

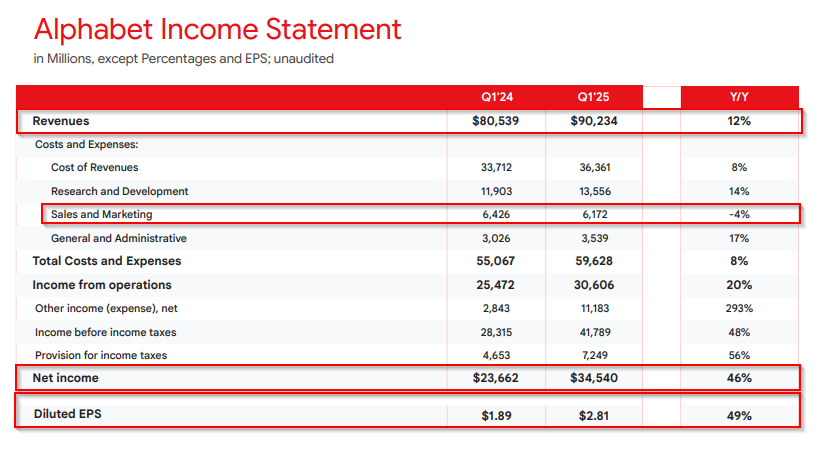

We can see the charts compared to Q1 of the previous year (2024):

Alphabet has had an increase in revenue (Revenues) without raising expenses too much (Total Costs and Expenses), which is very positive.

In the Sales and Marketing line item, a decrease in marketing expenses is observed along with growth in revenue, another point in favor.

Net Income: has increased by 46%, another positive point.

Diluted EPS (Diluted Earnings per Share): what does diluted mean? We will see this in detail in the advanced analysis, but basically it is when the company issues shares to pay employees, diluting shareholders. However, earnings per share have risen 49%, another point in favor.

Conclusion of the quick analysis

For now, setting aside the class action lawsuit involving Nordstrom’s executive team (of which Amie Thuener O’Toole is a part), everything we are seeing seems quite solid, as expected from one of the world’s leading companies. This suggests that Alphabet deserves a deeper analysis, so we will mark it for an advanced study.

Next, we will proceed with a completely different company, from another sector and another continent.