Volume and Market Capitalization

Volume

Volume represents the total number of units of an asset (stocks, bitcoins, ounces of gold, etc.) that have been traded (i.e., bought and sold) during a given period of time.

The higher the volume, the greater the activity and market interest in that asset. This concept is especially relevant when we compare the behavior of an individual investor with that of an investment fund.

Generally, an individual investor is usually not affected if the volume is low. However, an investment fund does face important limitations: due to the size of its positions, it is usually forced to buy or sell in several tranches, as an order that is too large could move the price against it.

What information do we get from volume?

Trading volume is key because it gives us a fairly clear idea of an asset’s liquidity. The higher the volume, the easier it will be to buy or sell without causing significant variations in price.

Conversely, if a stock has low volume, it can be difficult to find a counterparty when we want to sell. This can complicate both taking profits and limiting losses, especially in times of market stress.

Market capitalization or “Market Cap”

Market capitalization is the total market value of all outstanding shares of a company. It is calculated by multiplying the current share price by the total number of shares issued:

What information do we get from Market Capitalization?

Knowing the market capitalization helps us understand the real size of a company, whether it is a consolidated giant or a small company with greater growth potential.

In addition, this data tells us the weight that the company has within the market and is very useful for comparing companies with each other. In certain cases, a high capitalization can also serve as a warning signal: if a company does not generate profits but maintains a very high valuation, we could be facing a possible overvaluation, unless there are solid growth expectations that justify it.

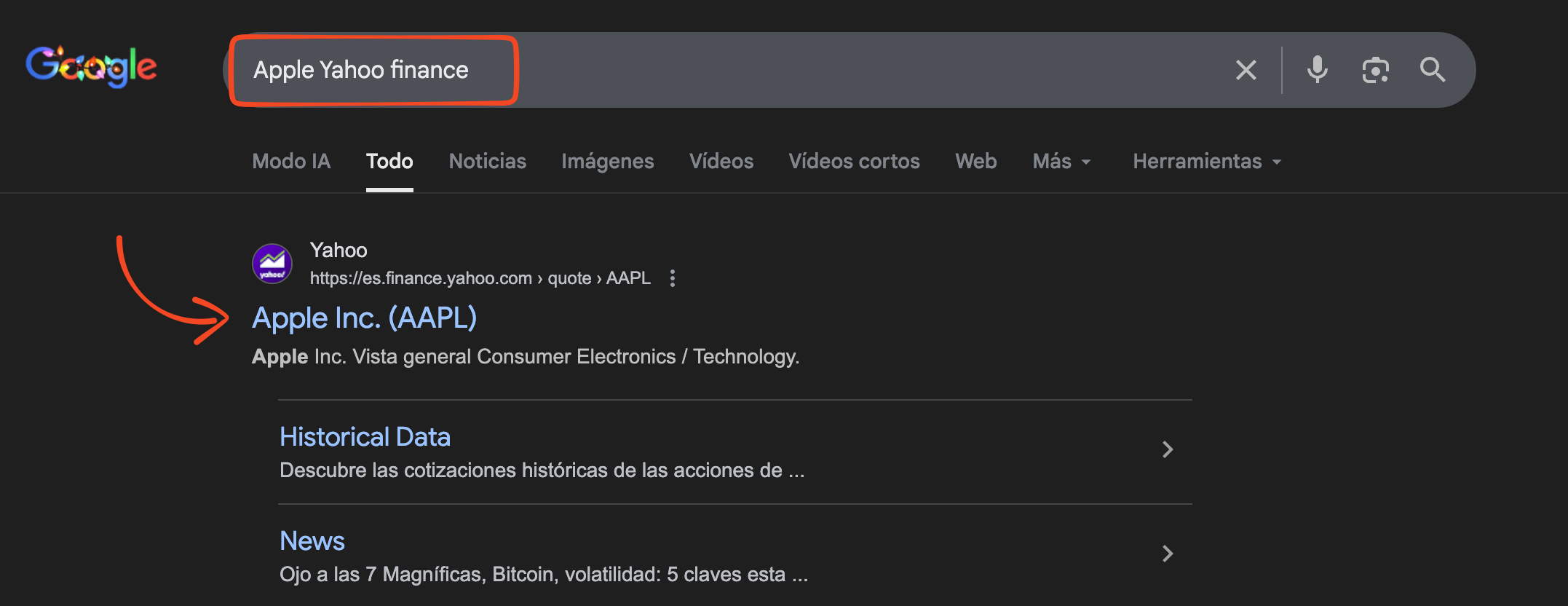

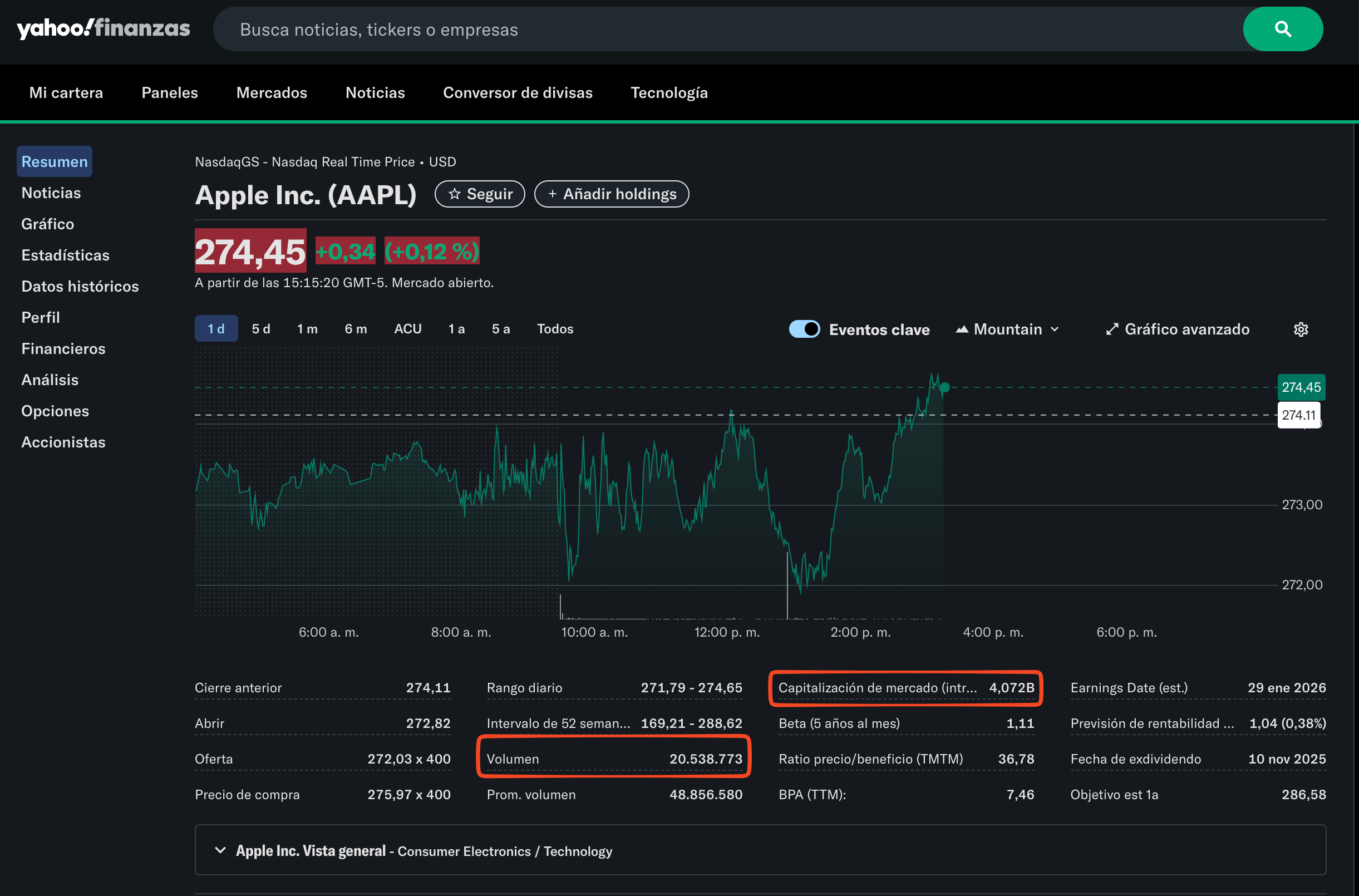

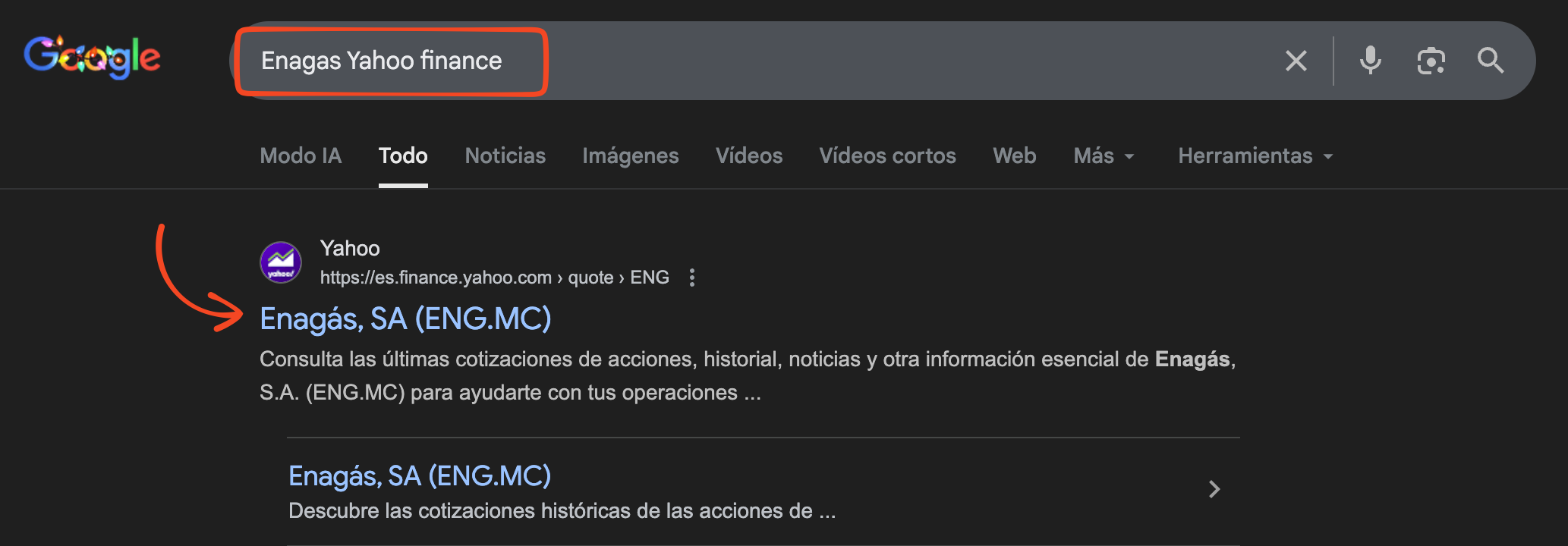

Where can we find Volume and Market Capitalization?

Very easy. Let’s see it with a practical example using the following companies:

- Enagás

- Apple

In the Google search engine, search for “Enagás Yahoo finance”

You will be redirected to the Yahoo Finance page, where you can find both trading volume and market capitalization.

Repeat the same process with Apple.