Where do the percentage returns come from?

In this article I will describe the percentage returns that appear on the main page.

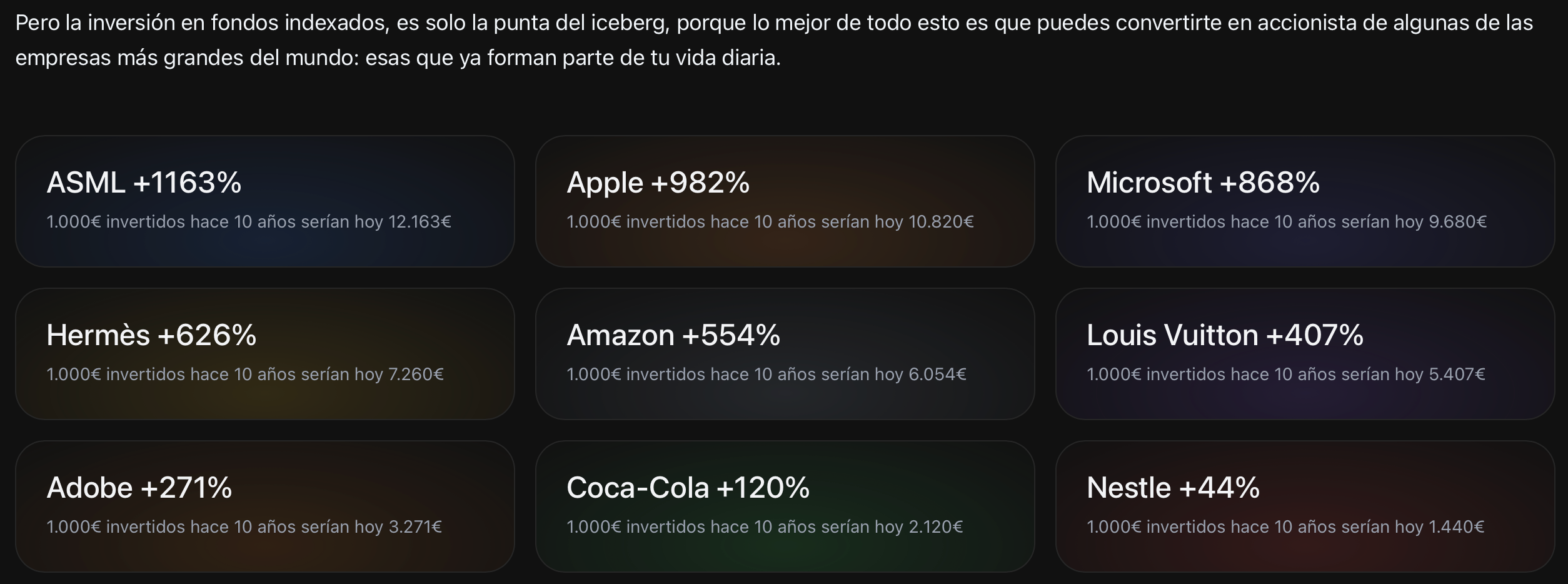

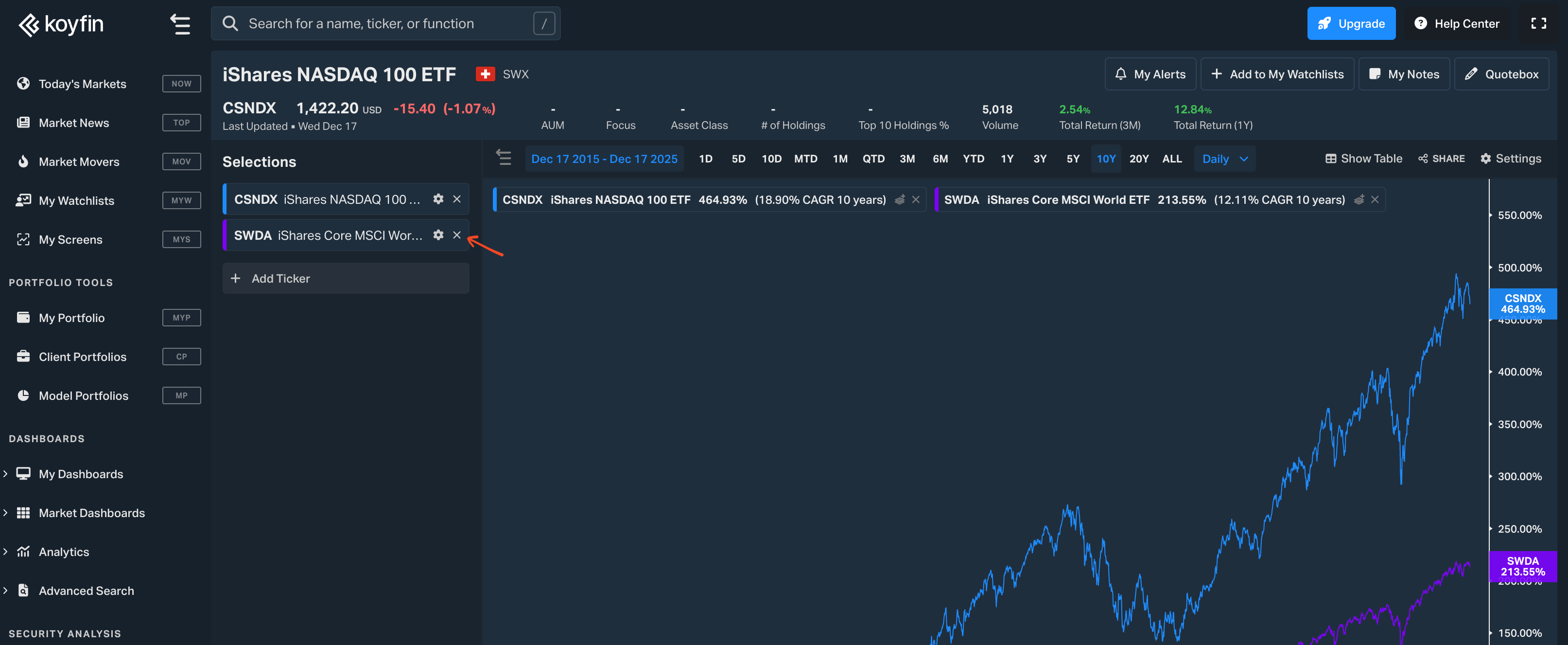

What percentages are we talking about?

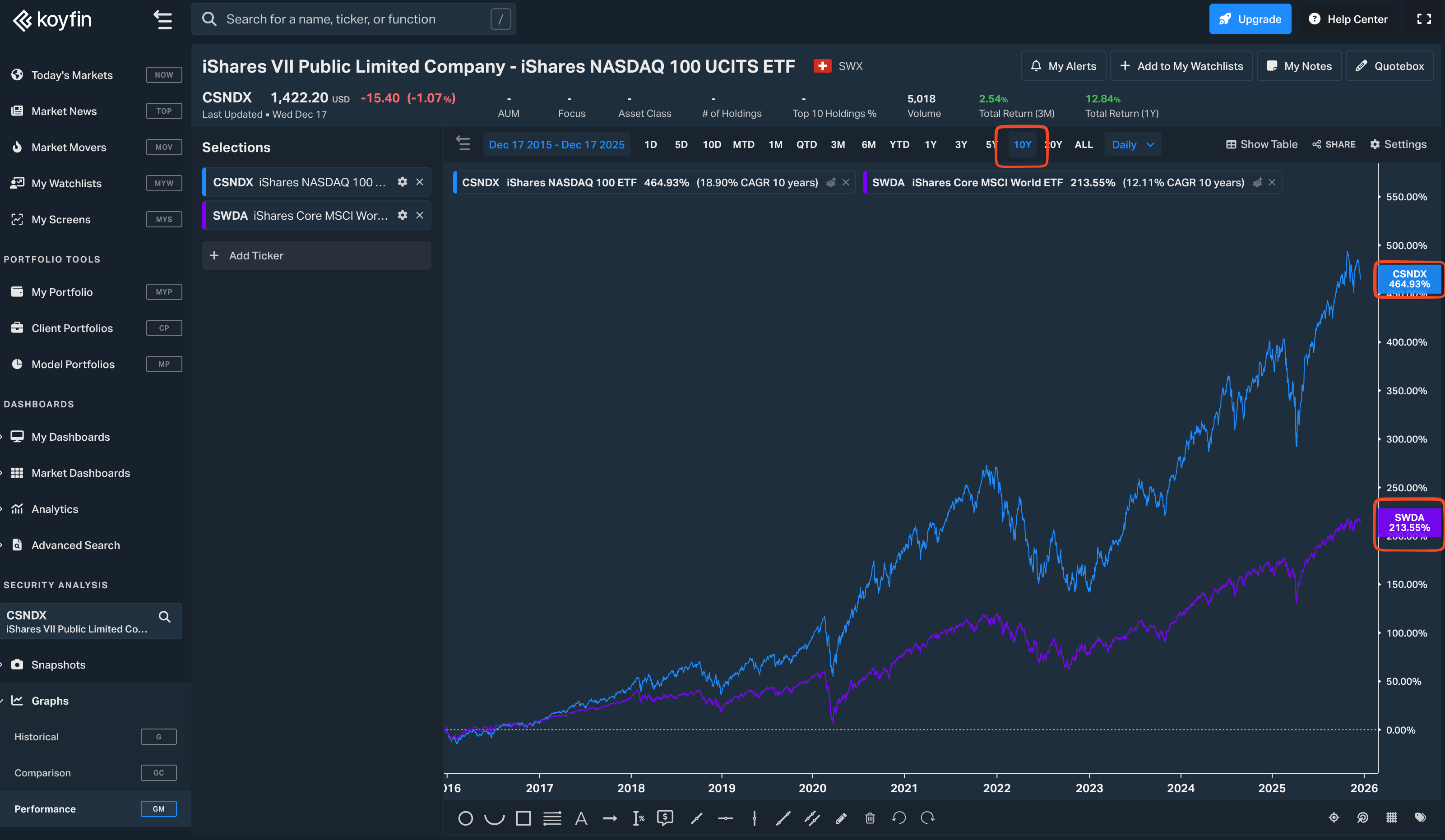

- NASDAQ +464%

- MSCI World +213%

Various stocks

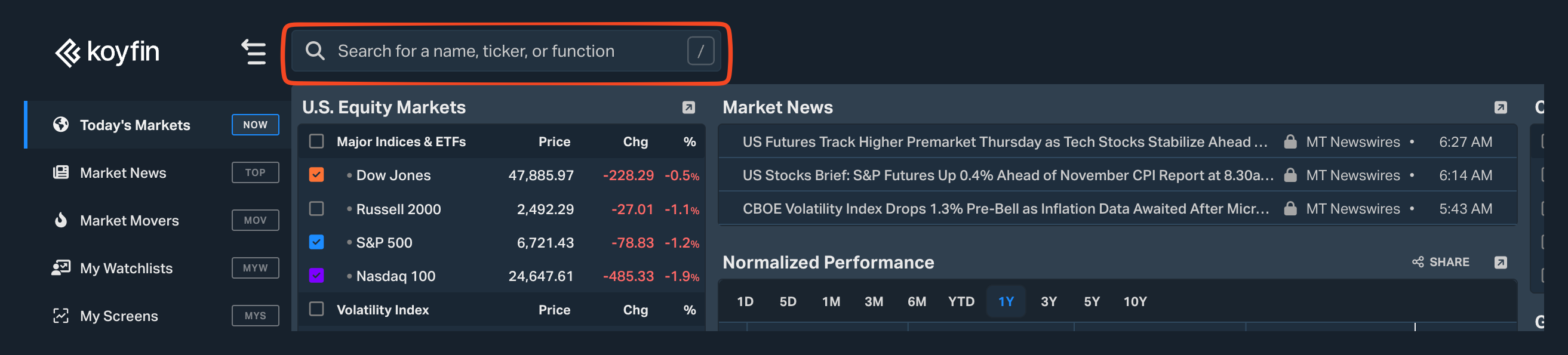

How can you check it yourself?

You’ll need to use the Koyfin tool (https://app.koyfin.com). Once you’re registered, make sure to use the correct ticker. In addition, we’ll use the Swiss stock exchange (the market), as it provides a 10-year historical data series.

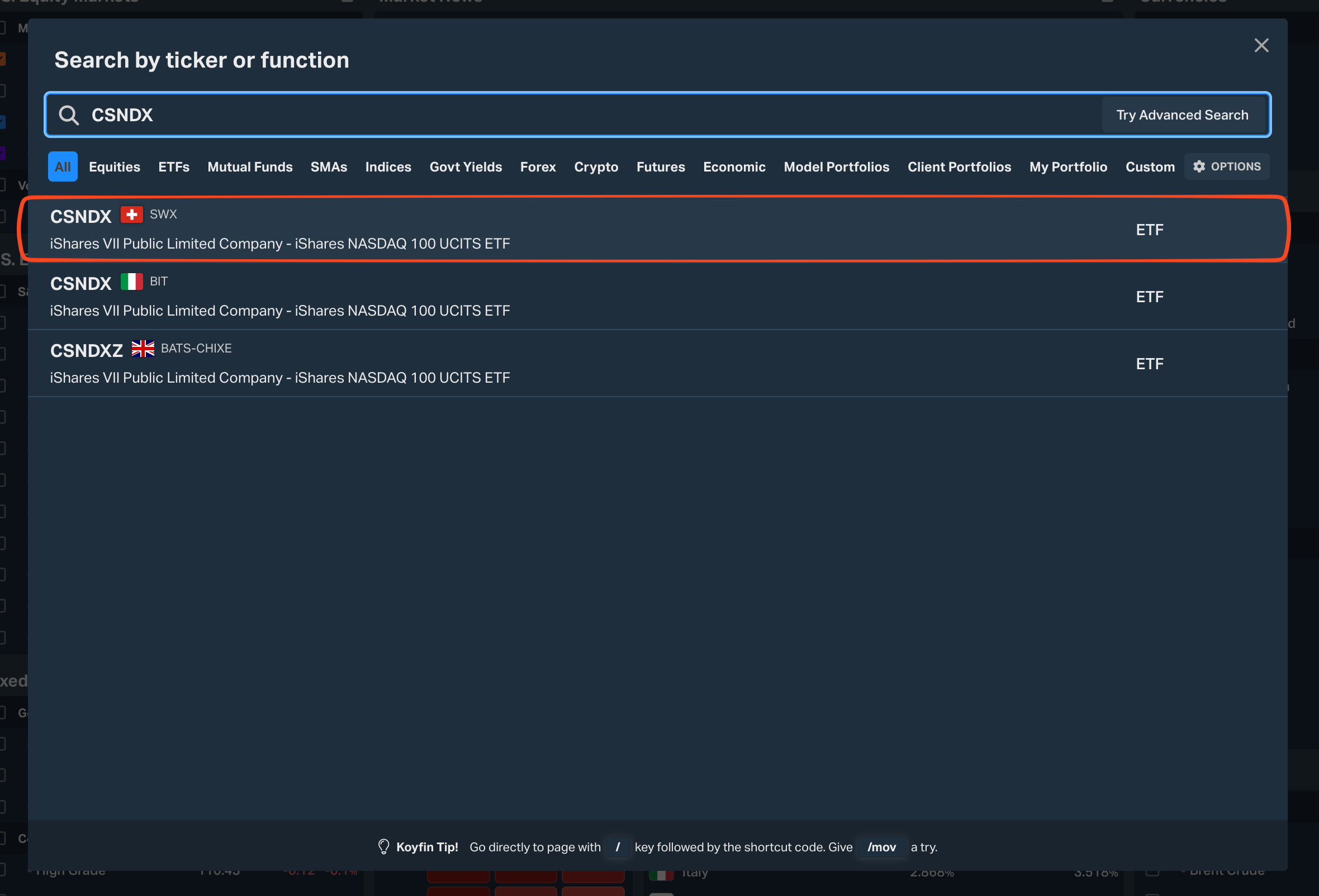

Nasdaq 100 (last 10 years)

- Ticker: CSNDX – iShares NASDAQ100 (Swiss Stock Exchange)

MSCI World (last 10 years)

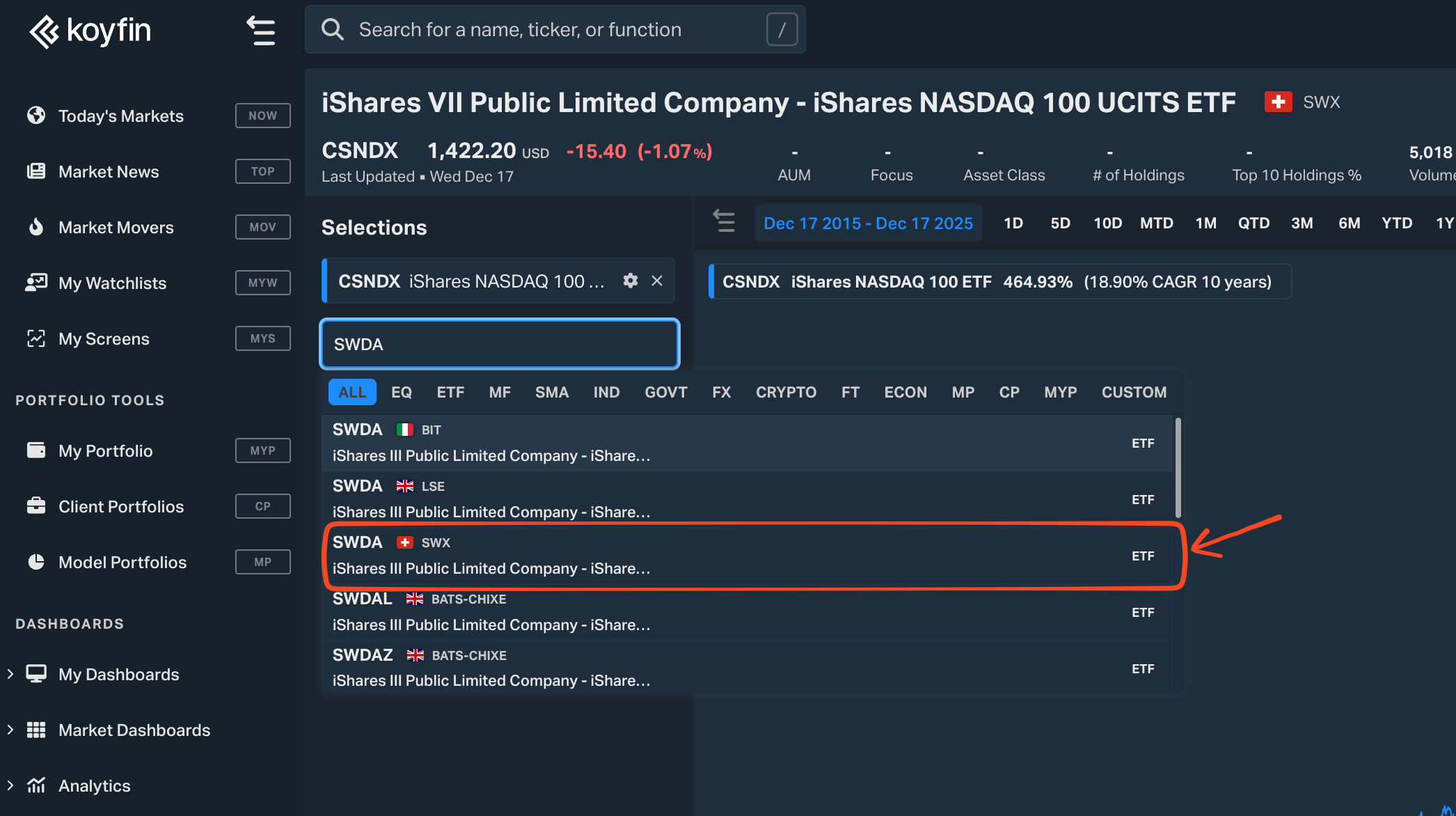

- Ticker: SWDA – iShares MSCI World (Swiss Stock Exchange)

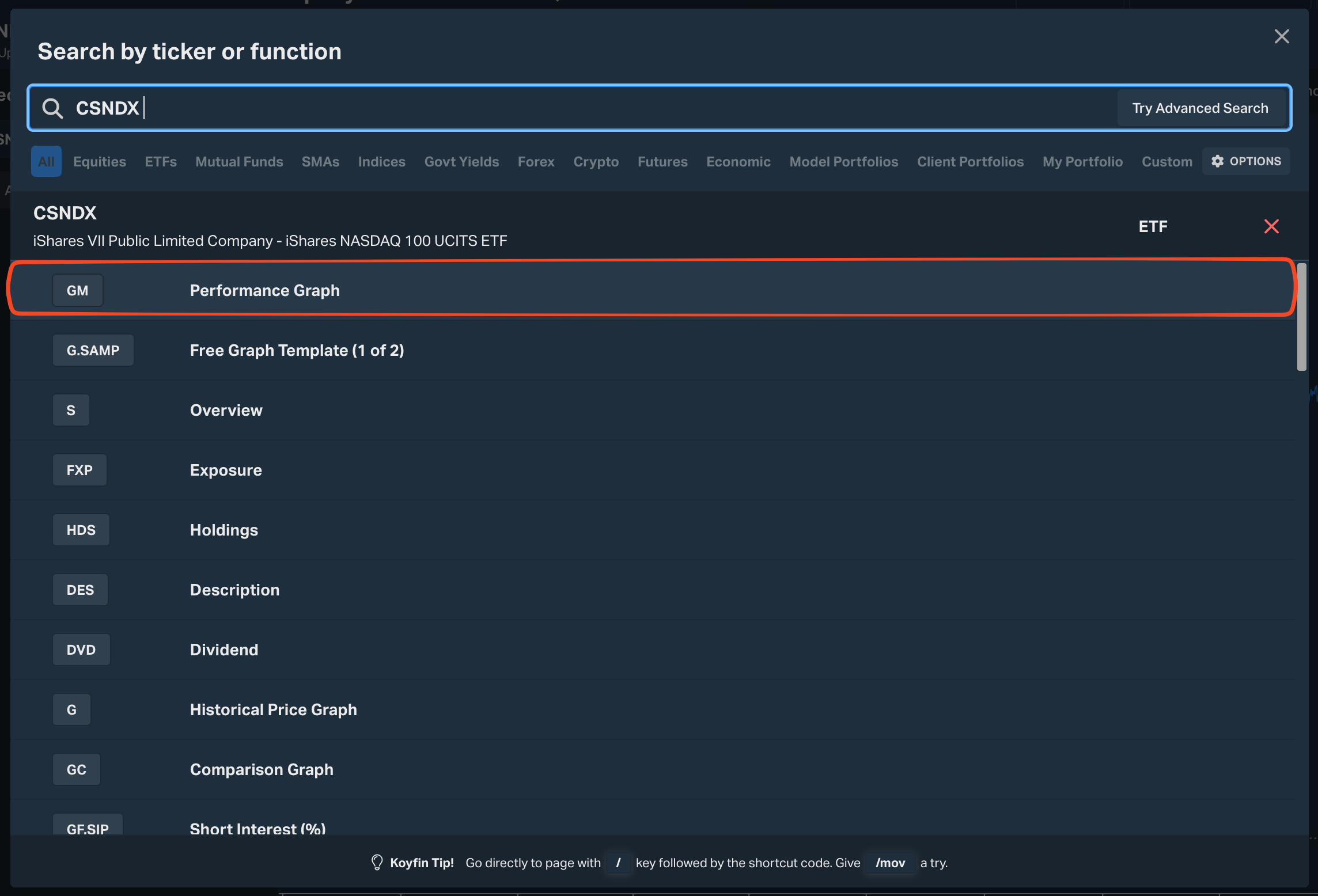

Click on the search area:

When the box opens, search for CSNDX and select the Swiss stock exchange

Select the GM chart - Performance Graph

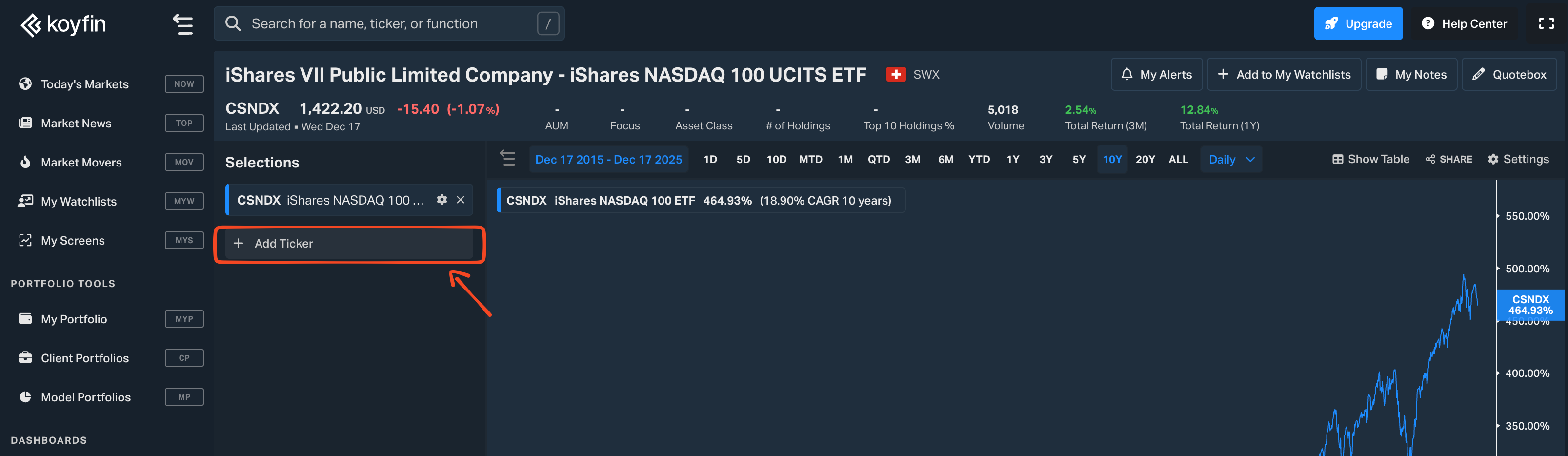

With the chart open, you can add the second Ticker SWDA (Swiss Stock Exchange)

Now check that the time period is set to 10 years (10y), and you should have the percentages that appear on the website.

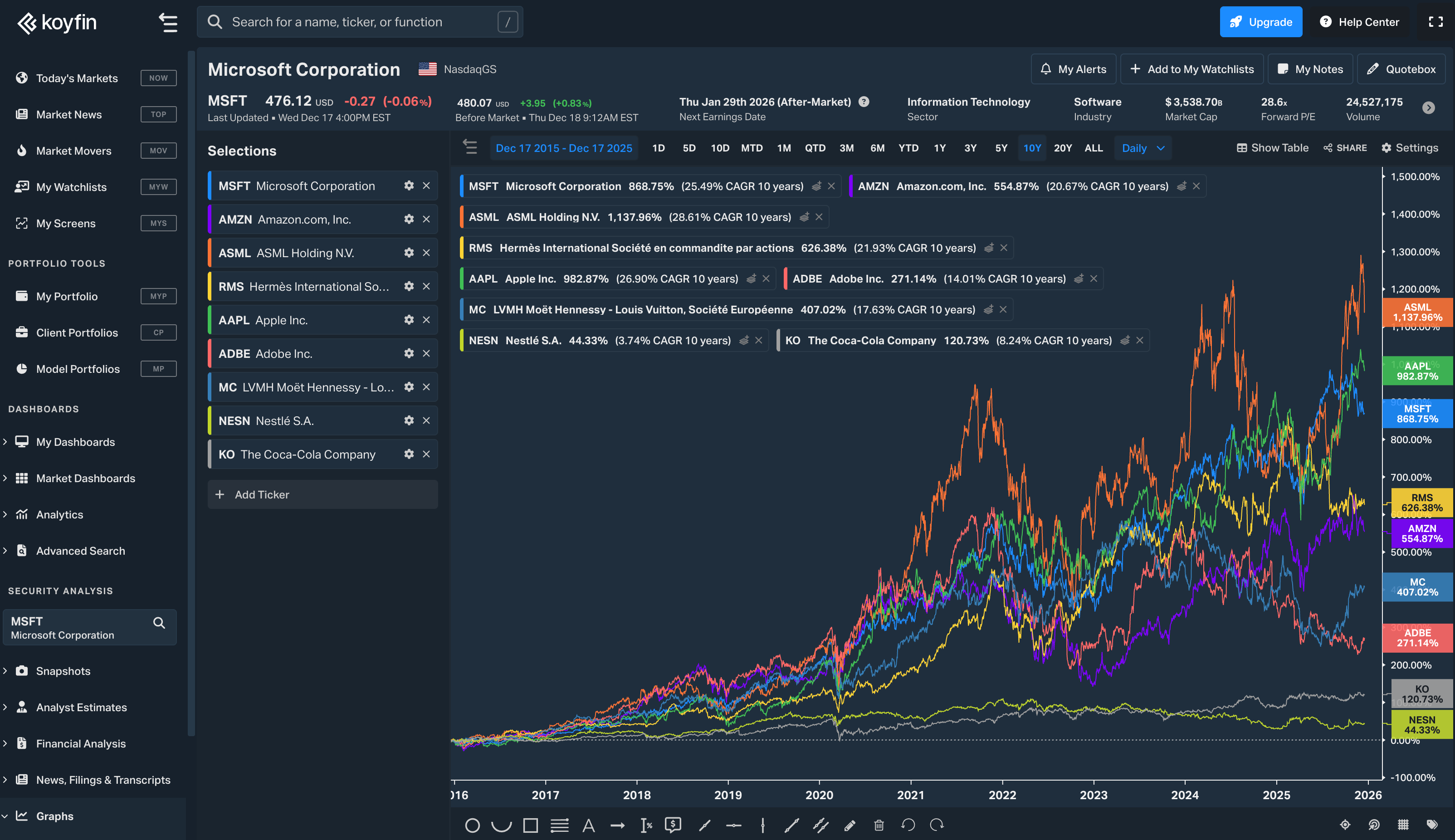

Now let’s look at the stock percentages.

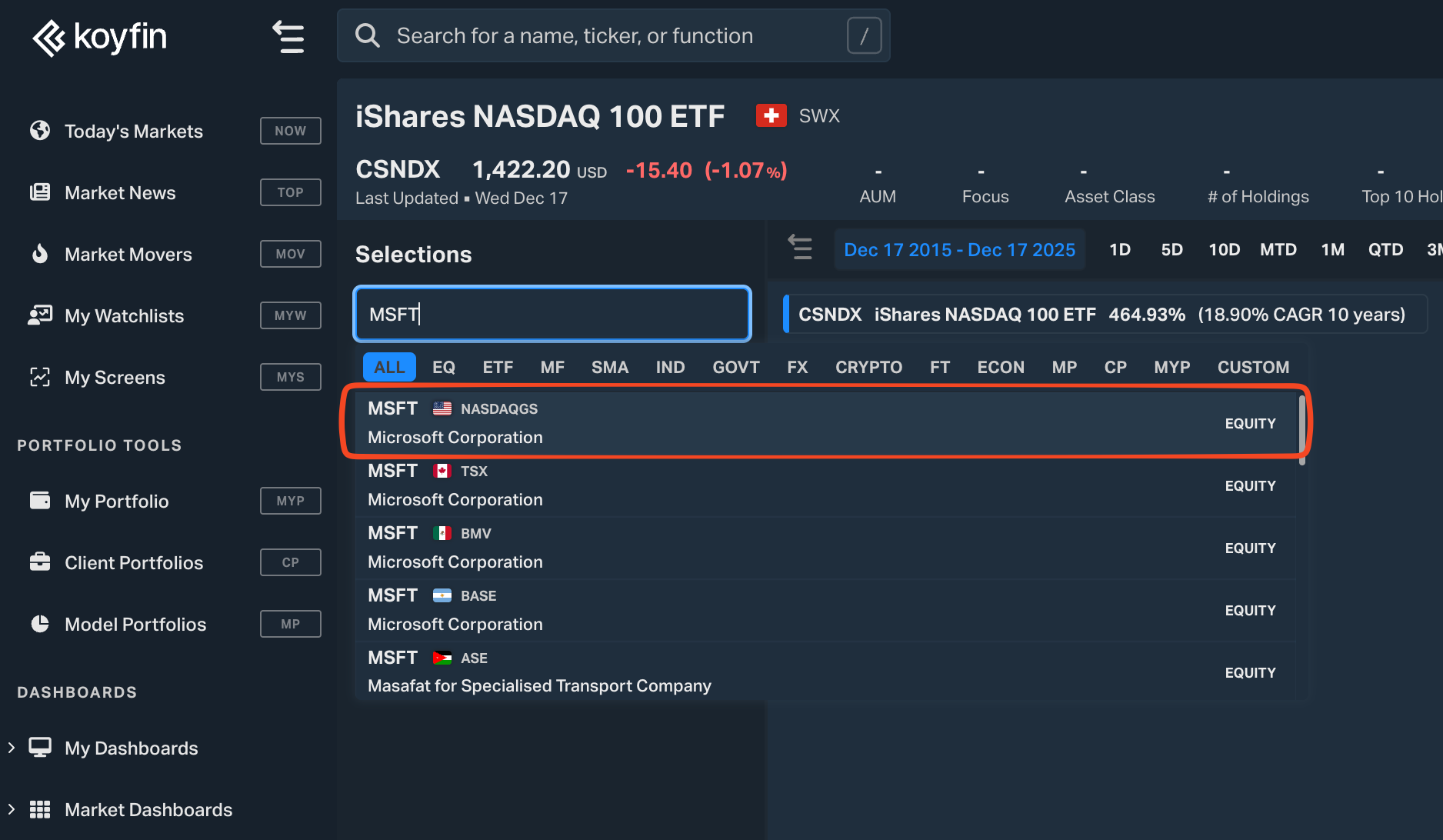

First, you will need to remove the ETFs you have selected, first SWDA and then CSNDX.

When you remove CSNDX, a box will appear asking for a ticker, here add the ticker MSFT (Microsoft)

Add all the other tickers

- ASML: ticker ASML, main market Amsterdam

- Apple: ticker AAPL, main market NASDAQ

- Microsoft: ticker MSFT, main market NASDAQ

- Amazon: ticker AMZN, main market NASDAQ

- Hermes: ticker RMS, main market Paris

- Louis Vuitton: ticker MC or LVMH, main market Paris

- Adobe: ticker ADBE, main market NASDAQ

- Coca-Cola: ticker KO, main market NYSE

- Nestlé: ticker NESN, main market Switzerland

Finally, don’t forget to check that the time period is set to 10 years, and in the end it should look something like this.