No Brokers

In this article I talk about the entities that, in my opinion, should not be used as an investment instrument. Throughout the text I call them “No Brokers”.

I have opened an account on X (formerly Twitter) to have some presence on social media. This morning I searched what people post under the “stock investments” category and a huge number of tweets appeared promoting entities such as “Trade Republic” or “Revolut”: free shares, investing is supposedly super easy and stress-free… Many people fall into that trap and, honestly, inside I am burning with rage.

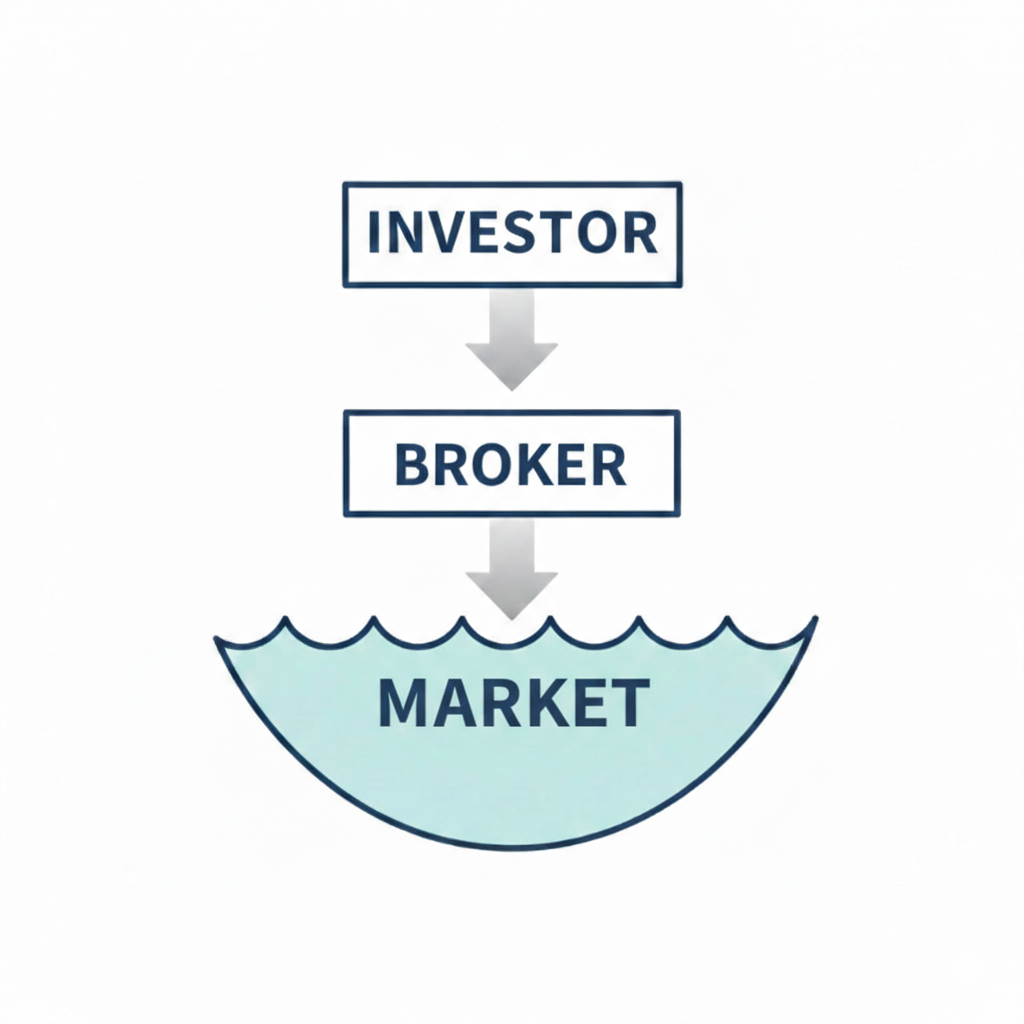

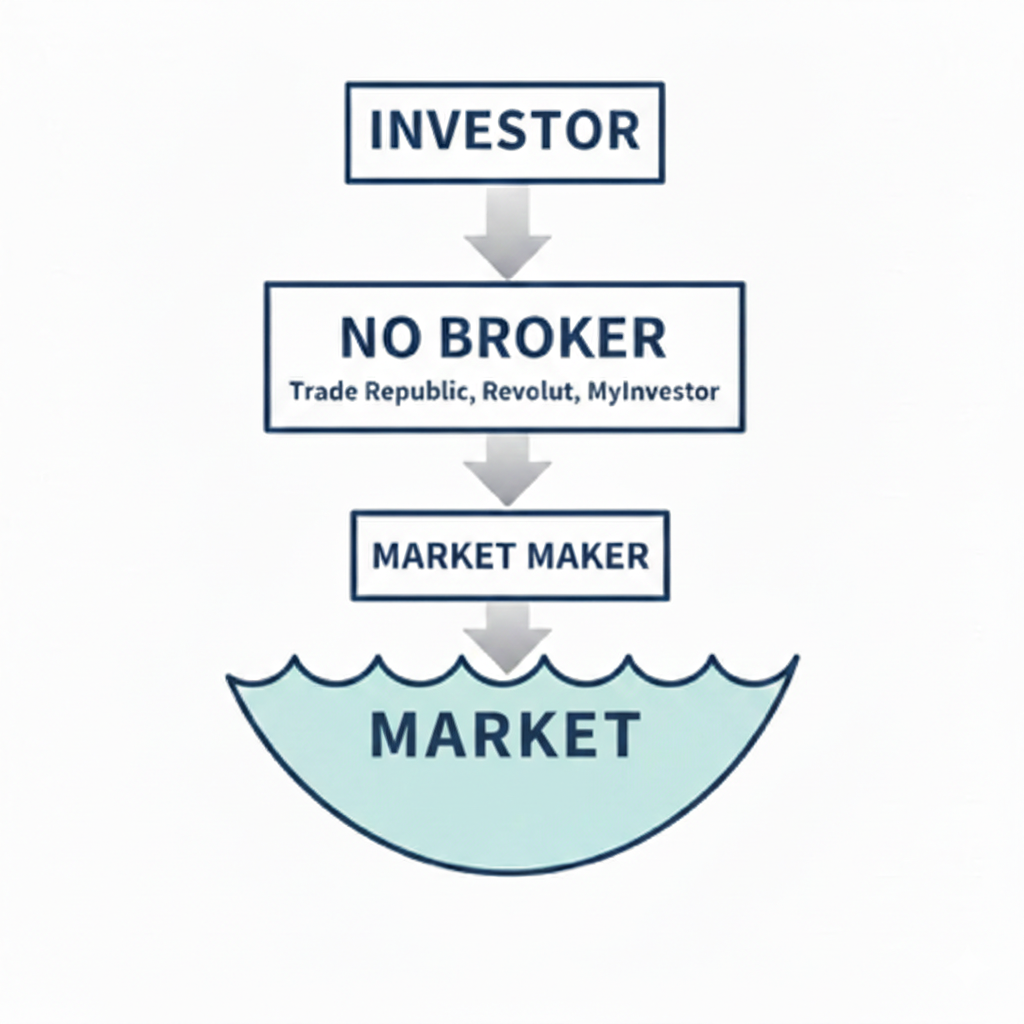

Although I will now go into detail point by point, I want to throw out an idea for you —the person reading this— to think about: these entities do not have permission to trade directly in the market and depend on companies known as “Market Makers”. In simple language: one more intermediary.

All parties want their slice of the pie. And the question I leave in the air is: will it be more beneficial for you, as an investor, to operate through entities that depend on these intermediaries, or to have a relationship with entities that do not need intermediaries and have permission to operate directly in the market?

Key questions:

- What is a broker?

- Who is a Market Maker?

- Disadvantages of NO BROKERS

- Is there a “general” rule to detect real brokers?

- Disadvantages of real brokers

What is a broker?

A broker, speaking clearly and to the point, is the intermediary that an individual uses to buy and sell financial assets: stocks, ETFs, bonds, funds, options… whatever is needed.

👉 You cannot go directly to the stock exchange (NYSE, Xetra, BME…) and say “give me 10 Apple shares”. You need someone with a licence, infrastructure and legal access. That someone is the broker.

Examples of real brokers:

- IBKR - Interactive Brokers: https://www.interactivebrokers.ie/

- Degiro: https://www.degiro.es

Who is a Market Maker?

It is a very large financial company, with very advanced technology, that lives from constantly buying and selling assets.

🧠 Who can be a Market Maker?

They are usually:

- Investment banks

- Algorithmic trading firms

- Companies specialised in providing liquidity

Very well-known examples (to give you a reference point):

- Citadel Securities

- Virtu Financial

- Jane Street (very famous in the US)

- Lang & Schwarz (Hamburg Stock Exchange)

- Large banks when they act as liquidity providers

These firms do not invest like you or me. Their business is:

- Millions of trades

- Very small margins

- Speed, volume and risk control

Where they sit in the “food chain”

Disadvantages of NO BROKERS

By NO BROKERS I mean companies that depend on a Market Maker in order to offer their clients investment products (assets).

- Trade Republic

- Revolut

Fees

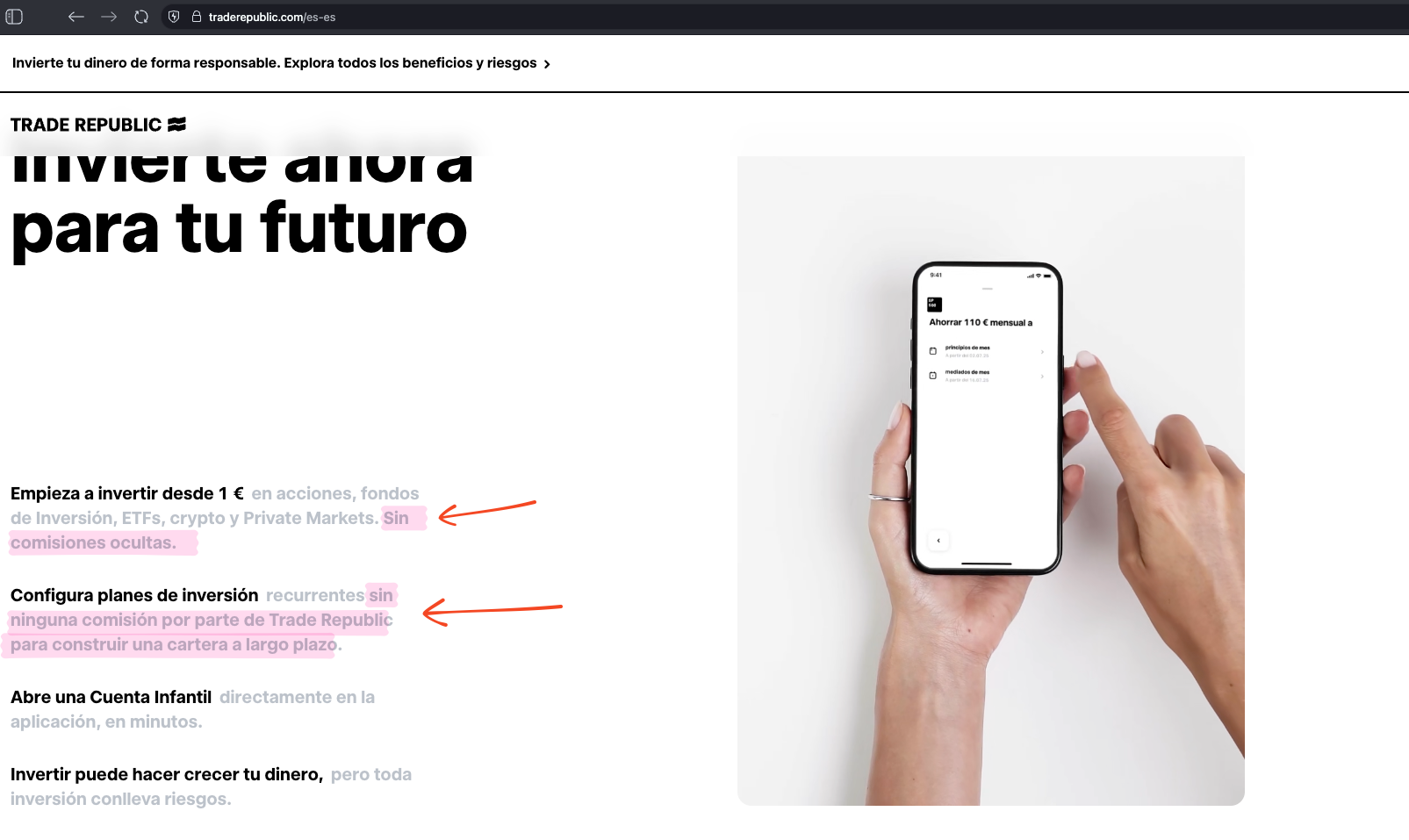

You will see that NO BROKERS offer you very low fees per trade. At first glance, that is fantastic, because as investors we want to pay as little as possible in order to obtain higher returns. But here is the trap.

For those of us who invest, there are two types of costs that we must keep very much in mind:

- The fee per executed trade

- The spread

A clear example of what the spread is: think of a currency exchange shop. The value of the currency will be X, but if you want to:

- Buy, you will pay a little more than it costs in the market.

- Sell, you will receive a little less.

Because NO BROKERS depend on an intermediary, they are subject to that intermediary’s conditions. And the intermediary will often widen the spread in order to make money on each transaction. It is not always done in an obvious or aggressive way, but you get the idea.

Order execution

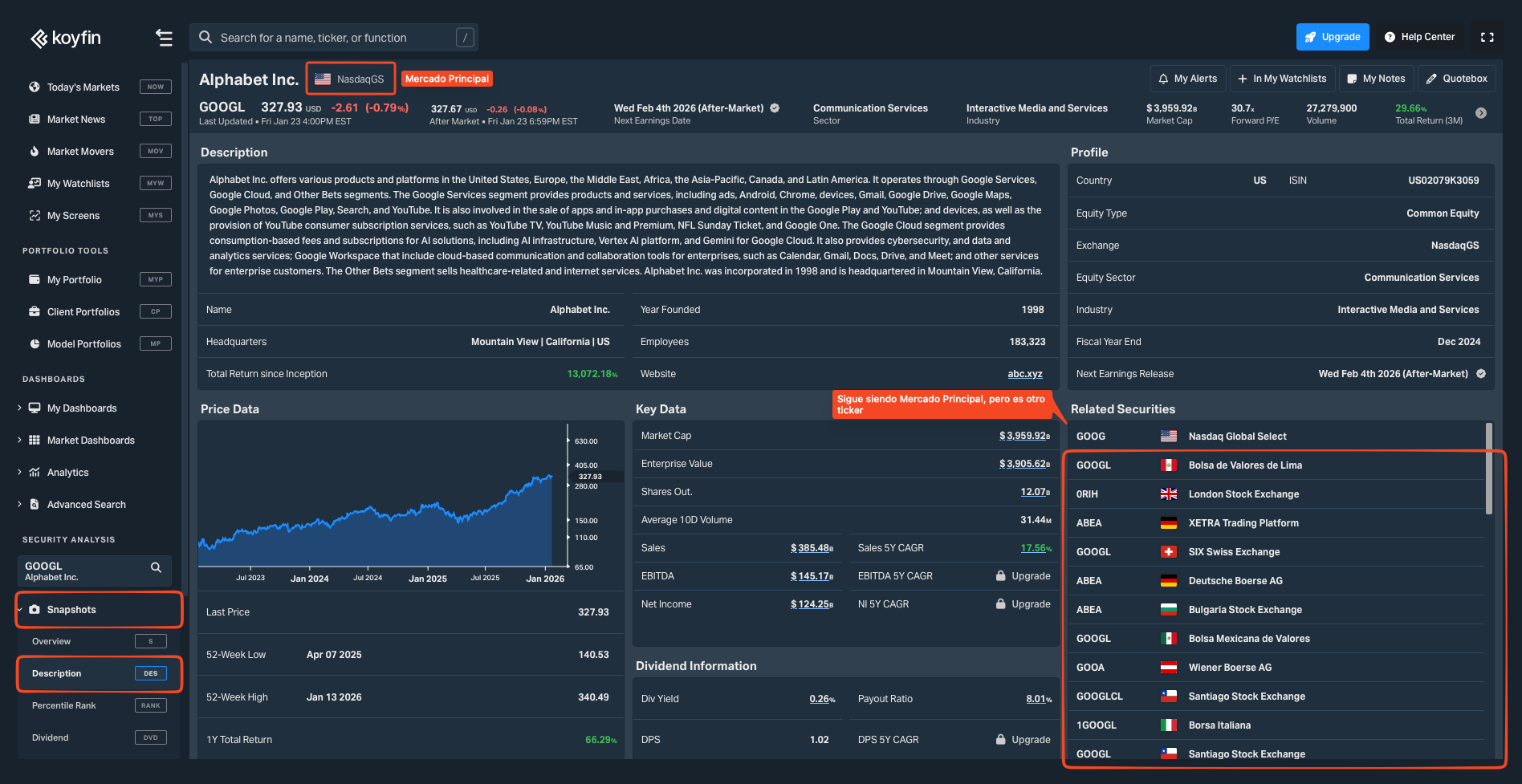

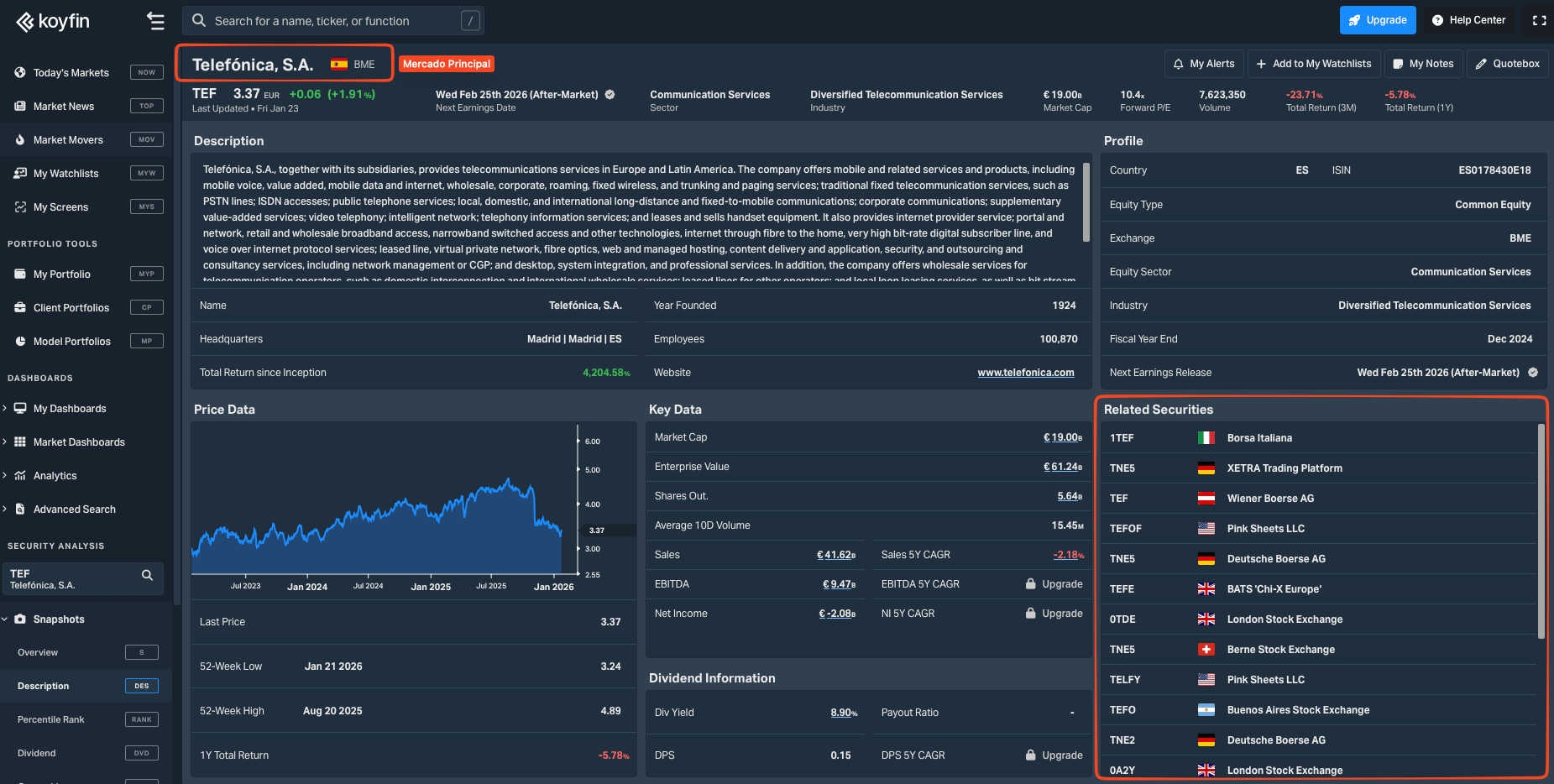

This point, for me, is even more important than fees. Market Makers do not always execute orders in the main market of the asset. Let’s look at an example:

- Alphabet: the main market for Alphabet is NASDAQ (US).

- Telefónica: the main market for Telefónica is BME (Spain).

As investors, where do we want our order to be executed? In 99.9% of cases, in the MAIN MARKET, because that is where there is usually a better price, better volume conditions, better currency conversion, etc.

Another illustrative example: you want to buy strawberries. Where do you think you will get a better price and quality? In a supermarket far from the fields, or directly from the farmer who grew them?

Is there a “general” rule to detect real brokers?

One could say yes.

You can clearly get lost in the black hole of licenses and legal requirements that legal brokers have to comply with, but personally I believe there is a safe, general and faster way to detect them.

Search for “Execution venues” (execution centers). Both brokers and NO BROKERS have to present them.

Let’s look at some examples.

NO BROKERS

On the list of “No Brokers”, the most popular ones I know are:

- Trade Republic

- Revolut

Trade Republic

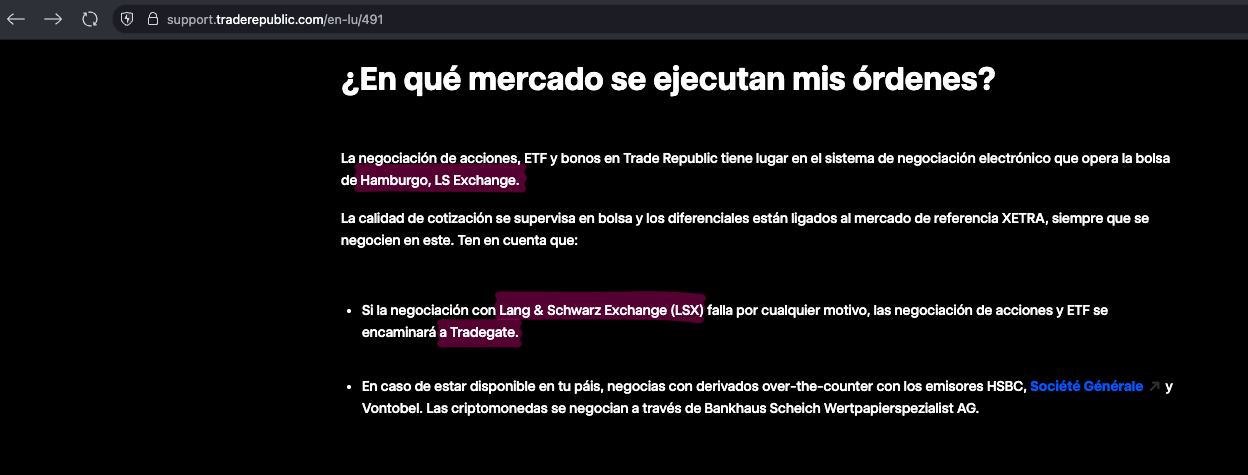

You can see the explanation of order execution on their page directly:

But let’s stick to “Execution venues”. Search in Google:

- Trade Republic execution venues

Click on the first result that appears:

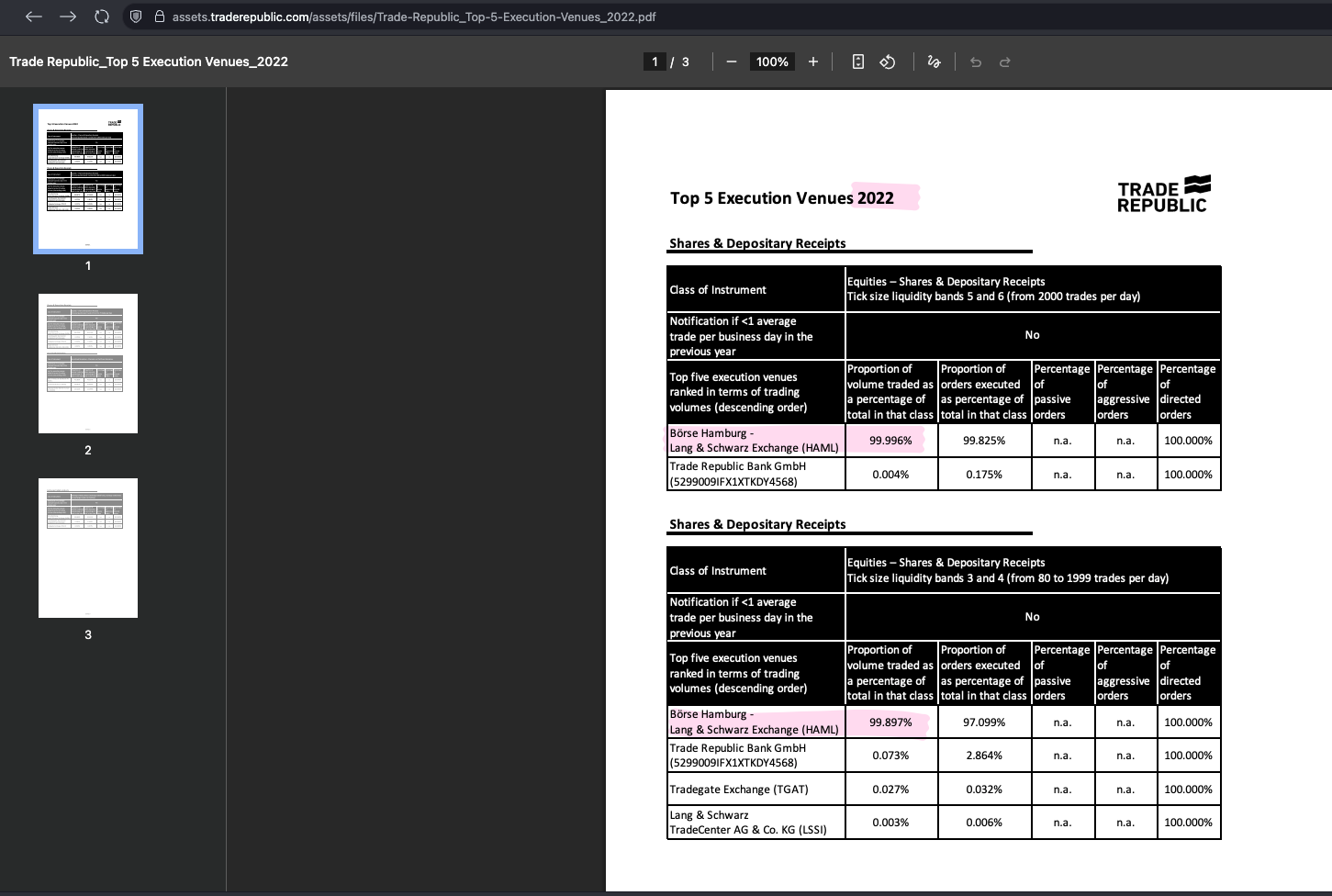

What do you observe in the image?

That for almost all the products they offer, execution is 98% on - Börse Hamburg - Lang & Schwarz Exchange (HAML)

Revolut

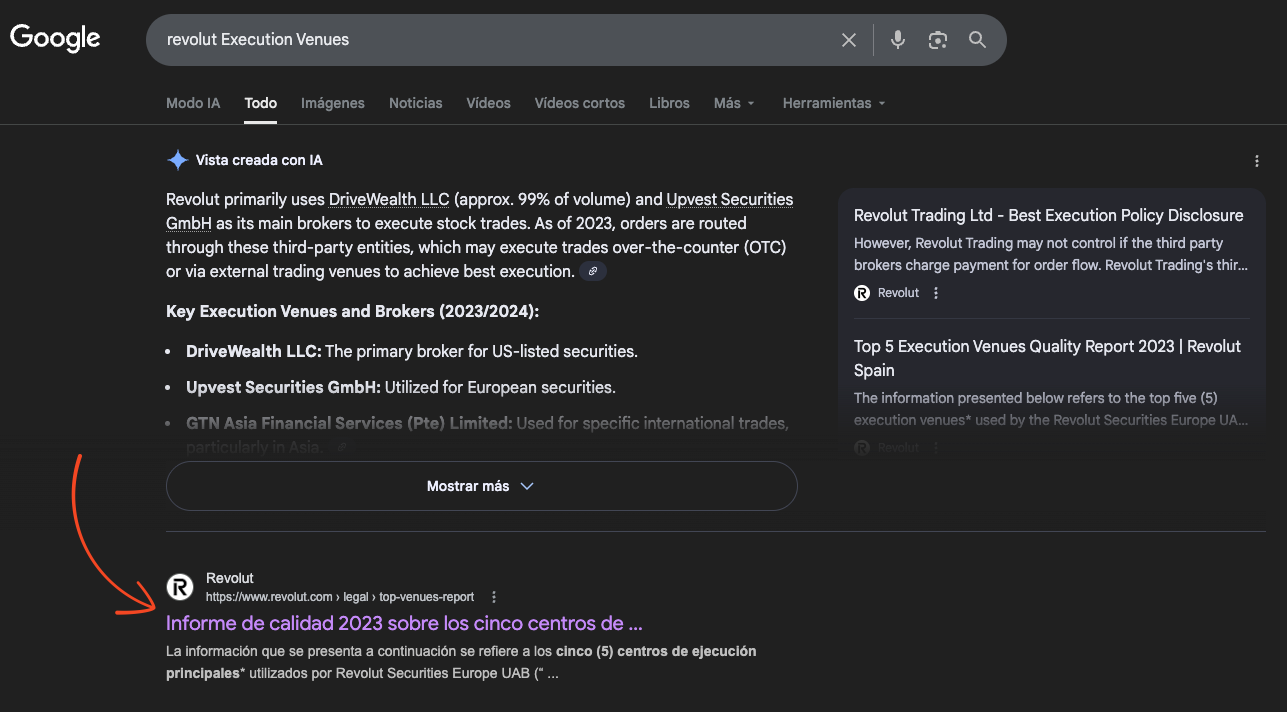

Let’s see where Revolut executes orders. Search in the browser:

- Revolut Execution Venues

Click on the first link:

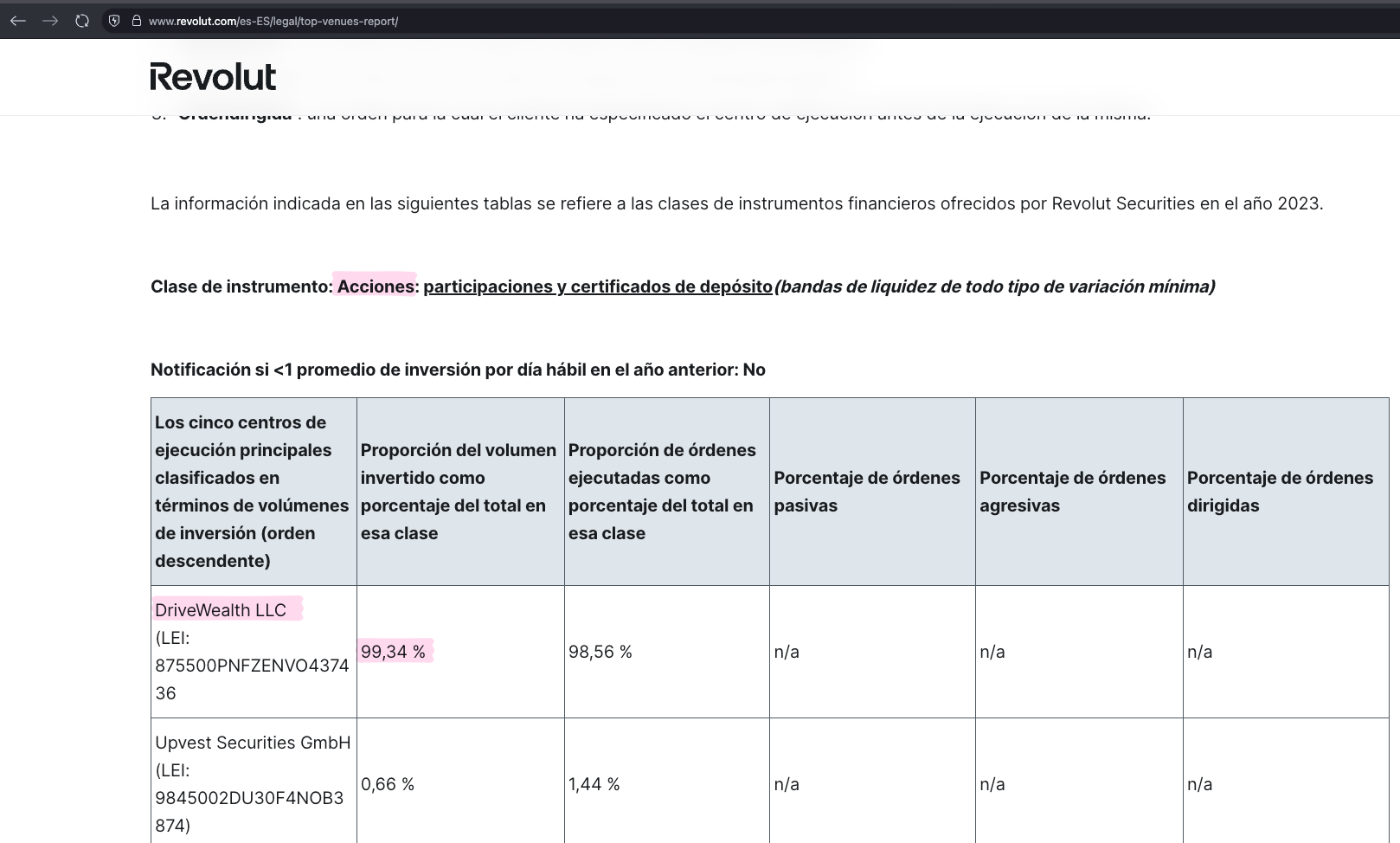

What do you see in the image?

Stock orders were executed 99.34% of the time with the entity: DriveWealth LLC (LEI: 875500PNFZENVO437436)

BROKERS

Now let’s look at an example of the execution venues of Brokers:

- IBKR

- Degiro

IBKR - Interactive Brokers

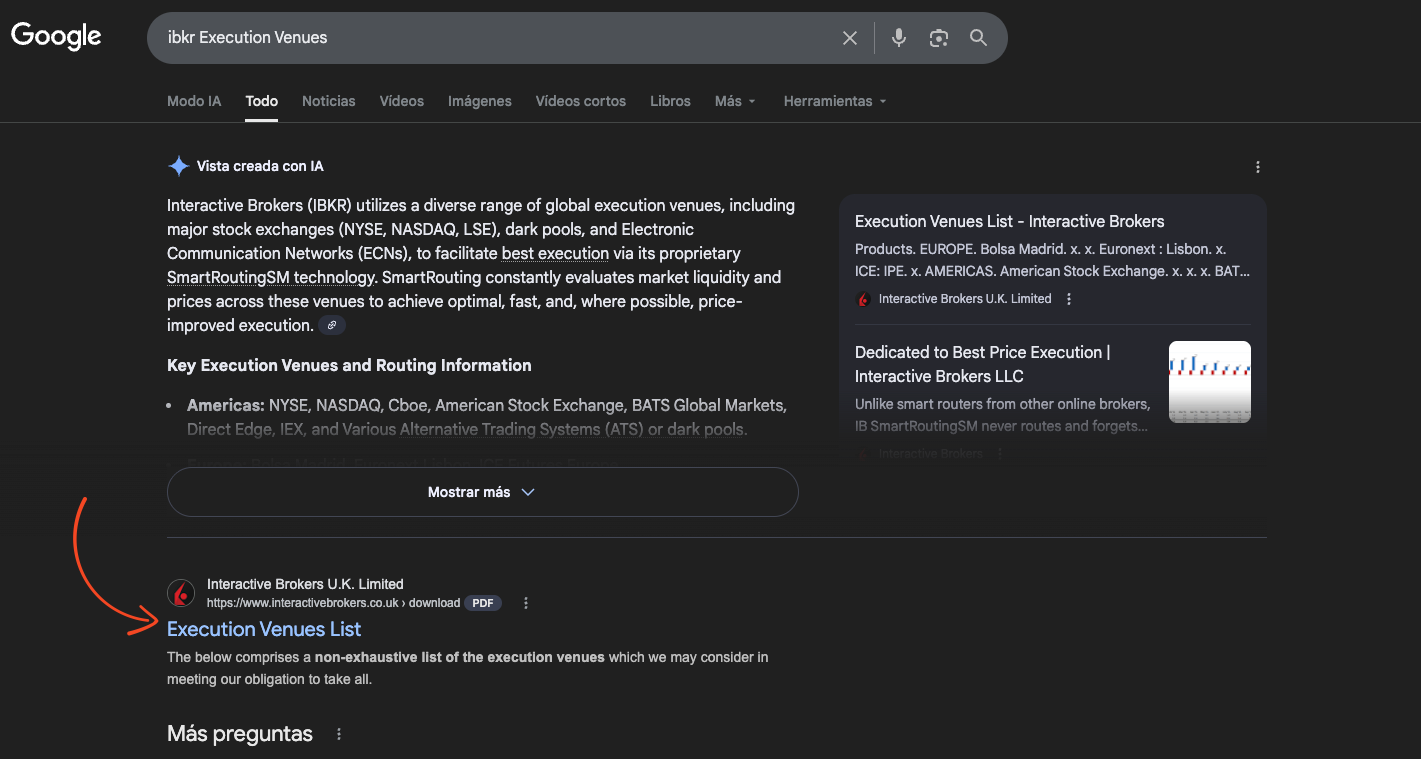

Search in the browser:

- IBKR Execution Venues

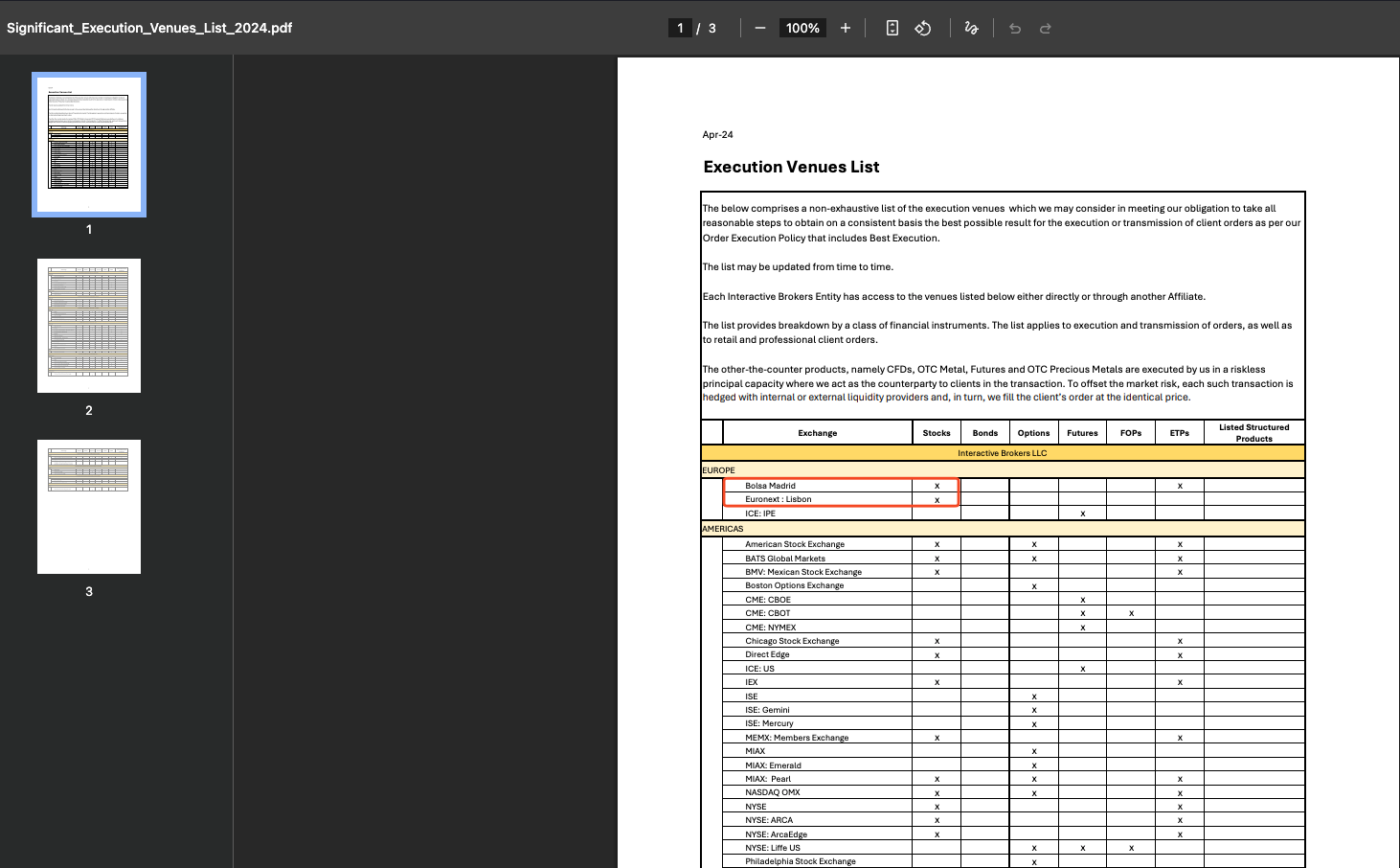

Click on the first result, and a pdf file downloads. When you open it, you’ll see the execution list. I don’t know if you see the difference, but it executes directly to market.

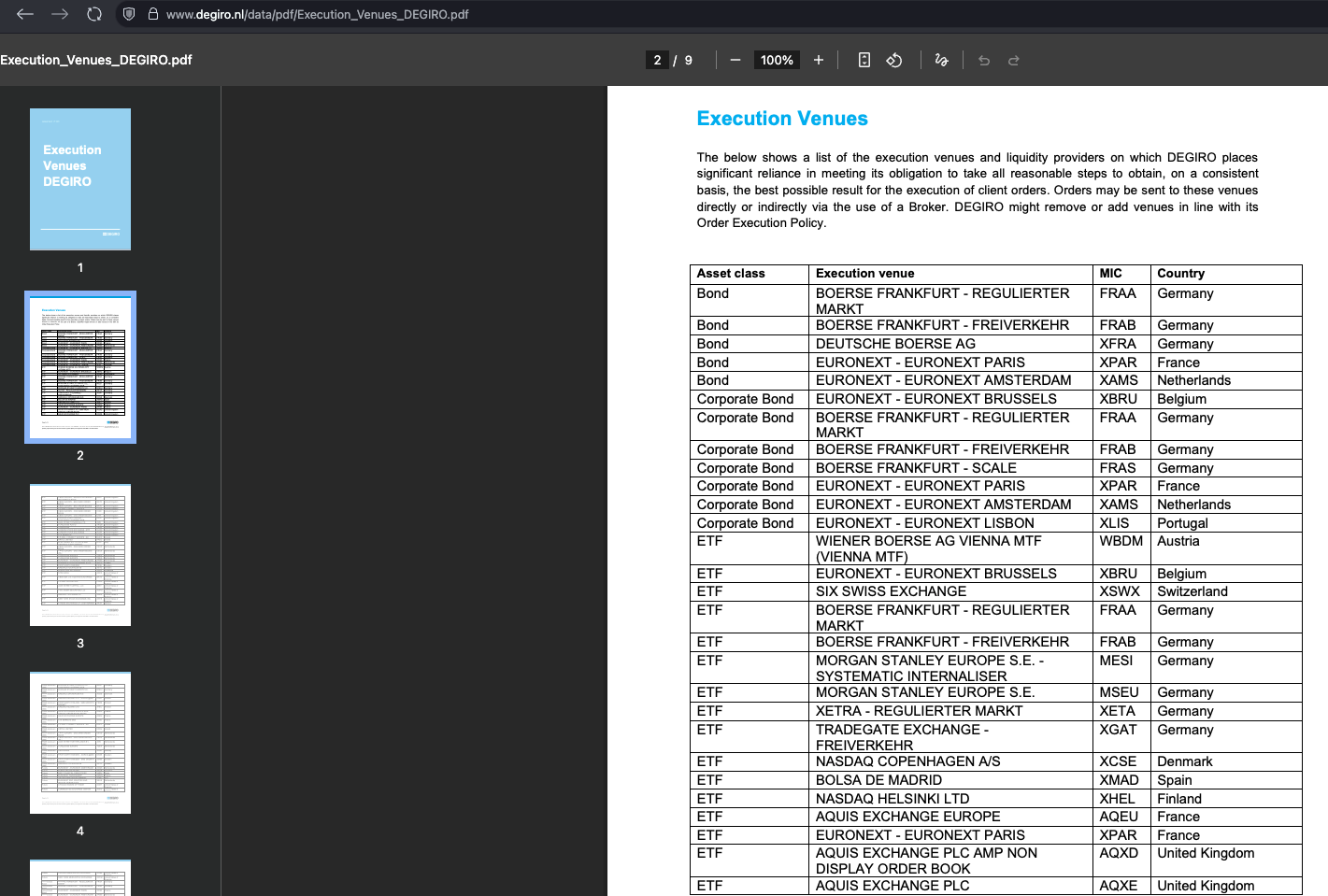

Degiro

Search in the browser:

- Degiro Execution Venues

Click on the first link:

Then, on their page, click on the pdf section:

You’ll see the following, the list is large, both official markets and Market Makers appear:

Disadvantages of real brokers

The only disadvantage that brokers have, personally for me it’s not an impediment, but I know that for many it can be, has nothing to do with investments, but rather with how you declare your gains.

You have to do it manually or hire services like TaxDown or similar.